Taxation, Revenue and Customs

Taxation, Revenue and Customs

The problem: It is difficult to validate receipts and documents issues by the various revenue and tax collecting departments of the government

There is a strong incentive for fraudsters to create fake or tampered receipts to fool the public and law enforcement agencies. With today’s software and printers, it is trivial to create these fake receipts - leading to loss of hundreds of millions of dollars of revenue. Apart from revenue leakage, this increases corruption and adds to friction in the economy which even honest taxpayers have to bear.

With income tax documents the problem can get further compounded by banks extending undue credit based on fake or inflated documents.

A non-exhaustive list of target documents is given below:

| Customs Receipts | Income Tax Assessments | GST Receipts |

|---|---|---|

| Certificate of Residency | Excise Duty Challans | Stamp Duty Receipts |

| Attestation Receipt | Import License Receipt | Export License Receipt |

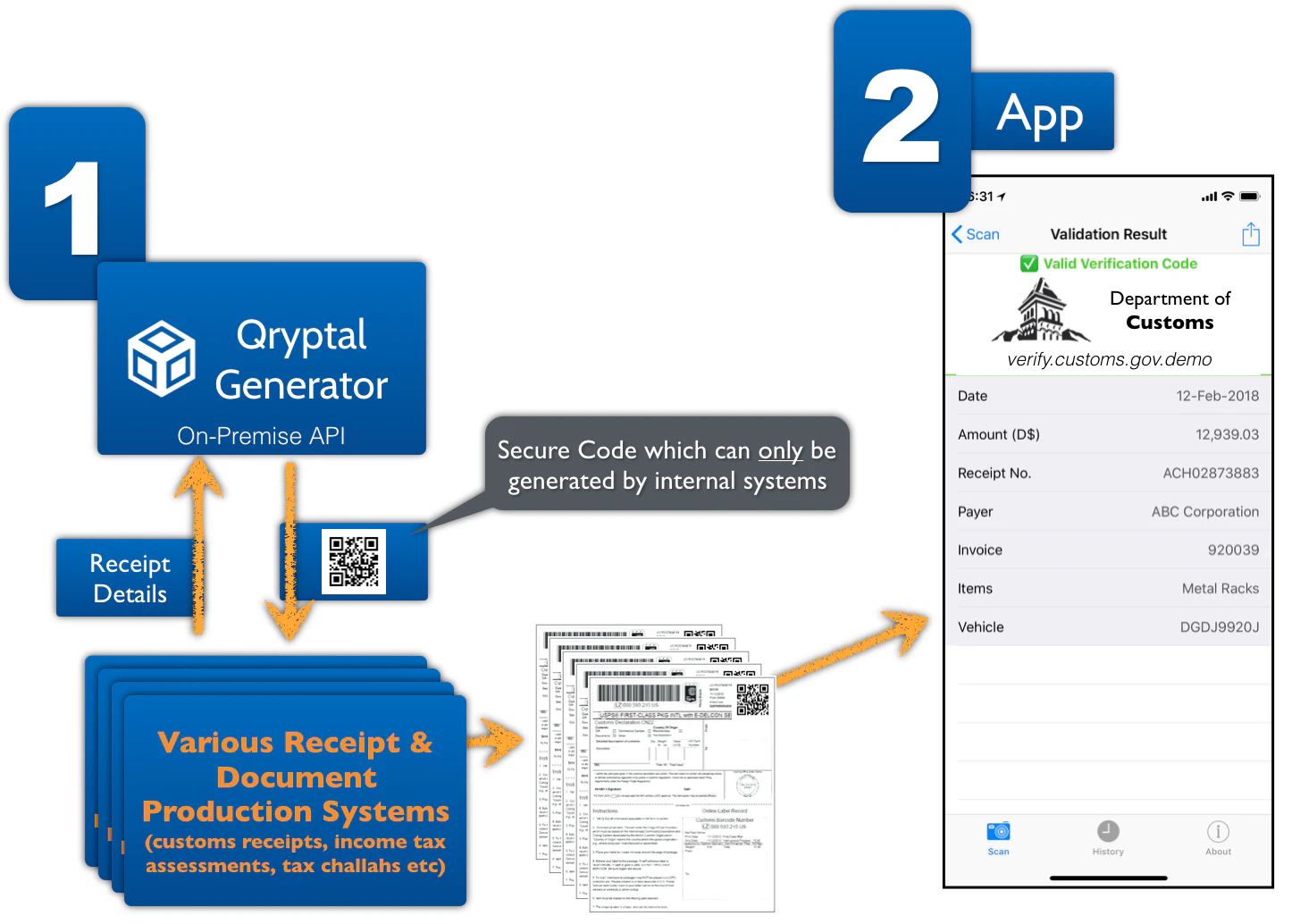

With the Qryptal Secure QR Code on receipts and taxation documents, any officer or member of the public can instantly validate the document

The Qryptal Generator can easily be integrated with the existing receipt and document production systems. Once integrated, the Qryptal QR Code will automatically get added to the document without any manual intervention.

- Easy integration with existing Receipt and Document Production Systems

- Easy for anyone to validate: simply scan the Qryptal QR Code with App

- All round security & privacy: validation with digital signature verification is performed by authorised App on device

- Can work on offline mode as well, hence even locations with no internet connectivity can validate

Leading organisations and brands rely on Qryptal

We have customers and users in most parts of the world.