Streamlining the Insurance Claims Process: Enhanced Security and Efficiency with Secure QR Codes

- Rajesh Soundararajan

- Apr 18, 2023

- 3 min read

Save Millions In Fake Insurance Insurance Claims

Introduction:

The insurance industry deals with a vast amount of documentation and sensitive information on a daily basis. The claims process, in particular, requires meticulous verification and validation to ensure accuracy and prevent fraud. Qryptal’s Secure QR Code technology offers a cutting-edge solution to streamline the claims process, enhance document security, and minimize the risk of errors and fraud. This blog post explores how Secure QR Codes transform the insurance industry by bringing greater efficiency and security to the claims process.

Challenges in the Insurance Claims Process:

1. Fraudulent claims: Insurance fraud is a major concern for the industry, with false claims leading to billions of dollars in losses each year. Detecting and preventing fraud is a constant challenge for insurers, who must balance efficiency with thoroughness when processing claims.

2. Manual errors: The claims process often involves handling large volumes of paperwork, increasing the likelihood of manual errors. These errors can lead to disputes, delays, and increased costs for both the insurer and the policyholder.

3. Time-consuming verification: Verifying the authenticity and accuracy of documents submitted during the claims process can be a labor-intensive and time-consuming task. Insurers must ensure that all documents are genuine and free from tampering while maintaining a timely and efficient workflow.

Qryptal’s Secure QR Code Solution:

Qryptal’s Secure QR Code technology addresses these challenges by providing a seamless and secure method for storing, sharing, and verifying information on documents involved in the insurance claims process. Key benefits of implementing Secure QR Codes in the claims process include:

1. Enhanced security: By embedding a secure, encrypted QR code onto each document, insurers can ensure that the information is tamper-proof and easily verified by scanning the code with a smartphone or other compatible device. This helps to prevent fraud and ensure the integrity of the claims process.

2. Reduced manual errors: Digitizing the claims process with Secure QR Codes minimizes the risk of manual errors. Information is securely stored and can be easily accessed and verified electronically.

3. Faster verification: With the ability to quickly scan and verify documents using Secure QR Codes, the claims process becomes more efficient, reducing the time and resources required for verification.

Real-life Use case:

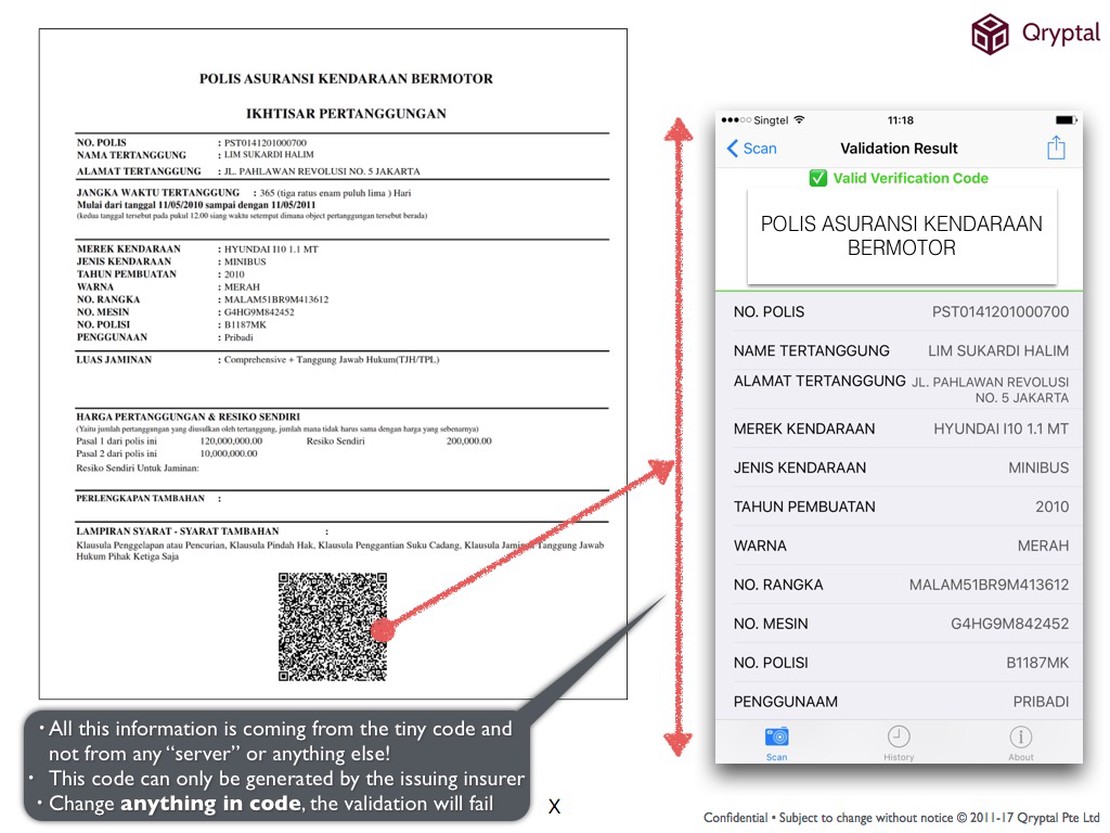

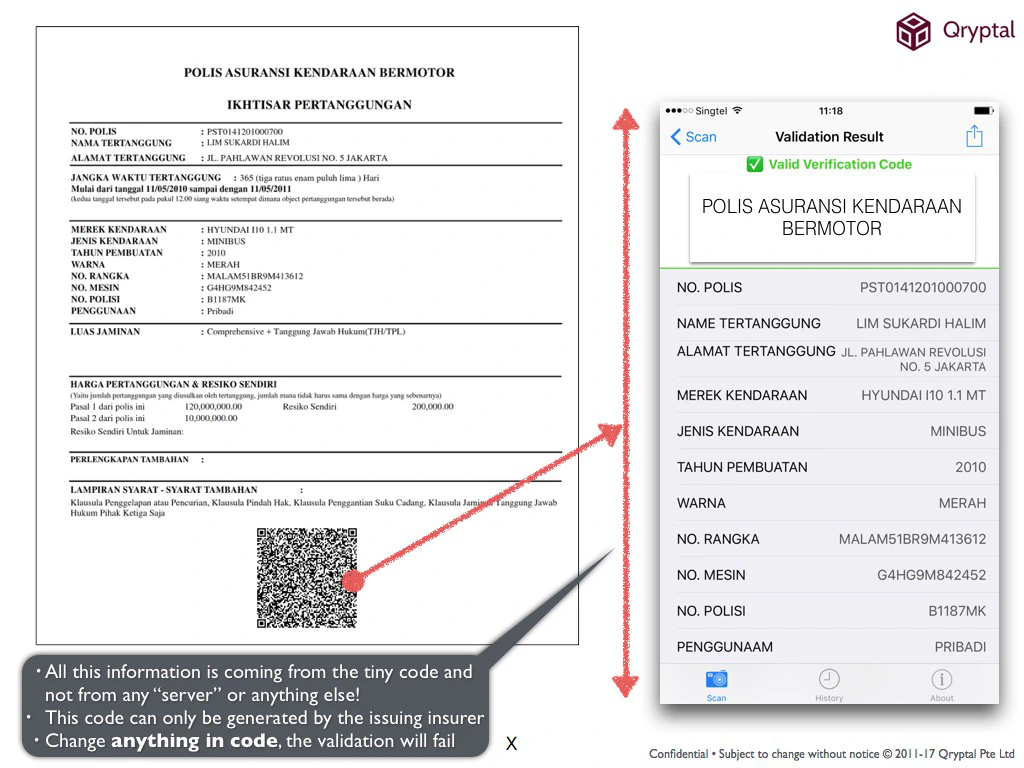

A sample of an Insurance Policy with a QR code encapsulating the details is shown here. On scanning the code, all the details inside it are visible for verification.

Conclusion:

Qryptal’s Secure QR Code technology offers a powerful solution for addressing the challenges faced by the insurance industry in the claims process. By enhancing security, reducing manual errors, and streamlining verification, Secure QR Codes are transforming the way insurers handle claims, leading to greater efficiency, cost savings, and improved customer satisfaction. As the insurance industry evolves, adopting innovative technologies like Qryptal’s Secure QR Codes will be crucial in driving success and staying ahead of the competition.

You may also like

- QR Codes for Health Insurance Membership Cards

- Secure QR Codes for Insurance Policy Documents

- QR Codes in Insurance Industry