Making Bank Account Statements Easily Verifiable for E-Visa issuance by Embassies and Governments

- Rahul Sinha

- Nov 28, 2023

- 5 min read

Seamless E-Visa issuance with secure bank account statements

Providing Secure Solutions With Qryptal’s Innovative Technology

Issuing visas in modern times should be quick and seamless. Since this depends on verifying the underlying documents and information submitted - it is important to have this in a form which can facilitate quicker processing without compromising on information security and applicant privacy. If the information can be provided to embassy staff and visa processing agencies which allows them to verify and trust the documents then this can significantly reduce transaction time and improve efficiency. This has spin off effects on not only tourism growth & revenue but also reduces the risks of issuing visas to undeserving individuals. Qryptal’s Secure QR Code technology can step up to meet these evolving needs and help facilitate this process. In this blogpost we will talk about one such important document - bank account statements which accompany visa applications.

The Current Verification Method : Falling Short

The traditional method of verifying the bank account statements is time consuming as it relies on either the visa issuing agency checking with the issuing bank or asking the applicant to get an attested bank account statement. There are issues of data privacy and while mechanisms like attestation etc provided some level of reliability in the past, they are proving ineffective and obsolete in the increasingly technologically advanced world. They are prone to tampering and forgery or even human error since the processing is manual.

Qryptal’s Secure QR Code Technology: Significant Benefits

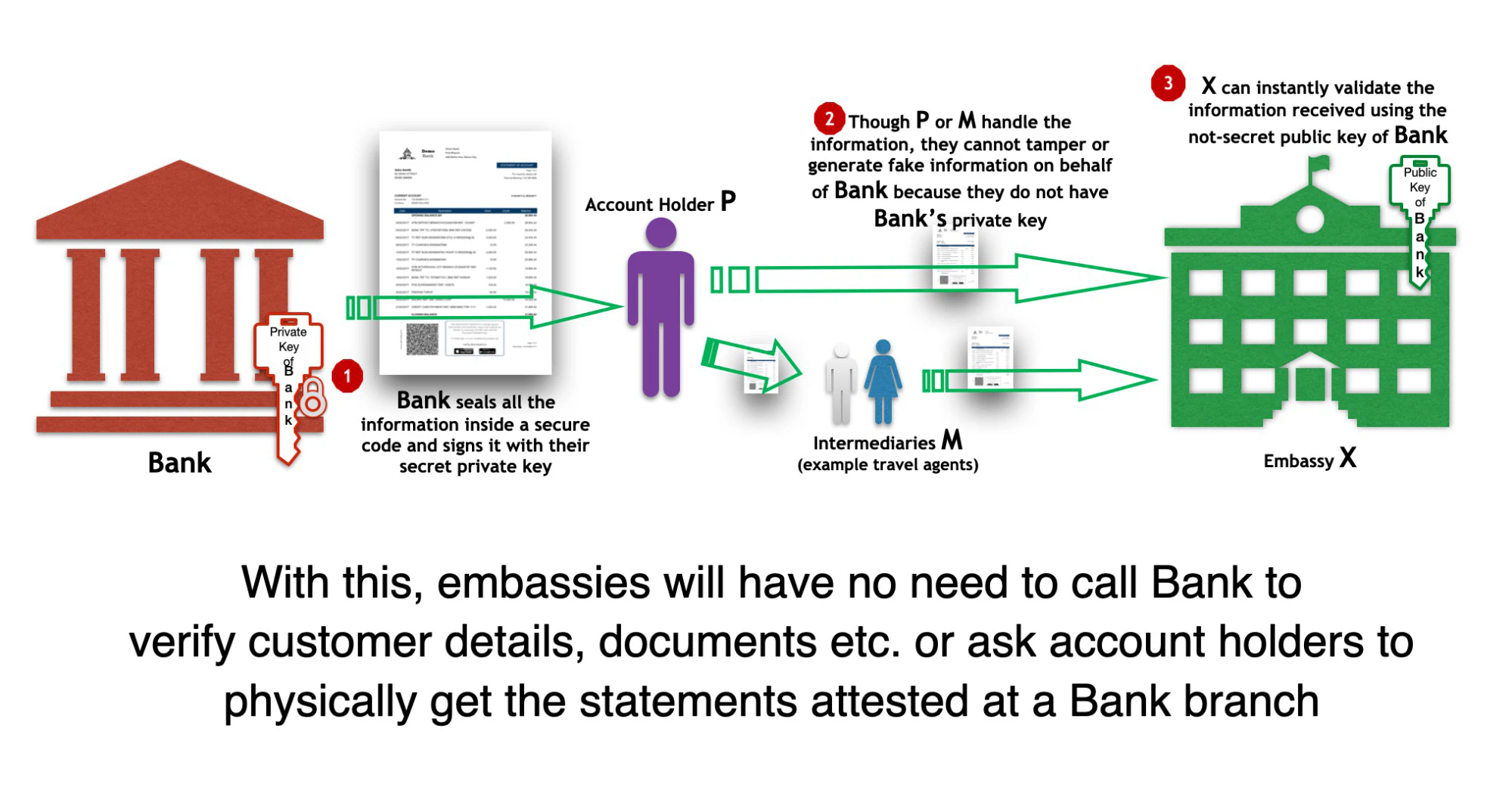

Qryptal’s Secure QR Code technology rises above the challenges posed by conventional methods and the limitations of regular QR codes. By embedding vital information directly into the QR code and digitally signing it with the issuer’s private key, Qryptal has blended security, convenience, and reliability into one indispensable solution.

Flexible

QR codes are versatile, easily accommodating physical as well as digital document systems. Whether a paper or a digital bank account statement, Qryptal’s Secure QR codes provide a consistent safeguard.

Secure with Data Privacy

The data within these codes are signed digitally, making them unassailable to tampering attempts. This reduces fraud. Data Privacy is also ensured as information is validated without unwanted data leakage and risks.

Efficient

Secure QR codes introduce operation efficiency by eliminating the need for databases or complex verification processes. A simple mobile device scan or a web validation mechanism for instant self service validation is all it takes to validate the information and authenticity, saving time and improving user experience. Automated validation is also possible which eliminates or reduces human error.

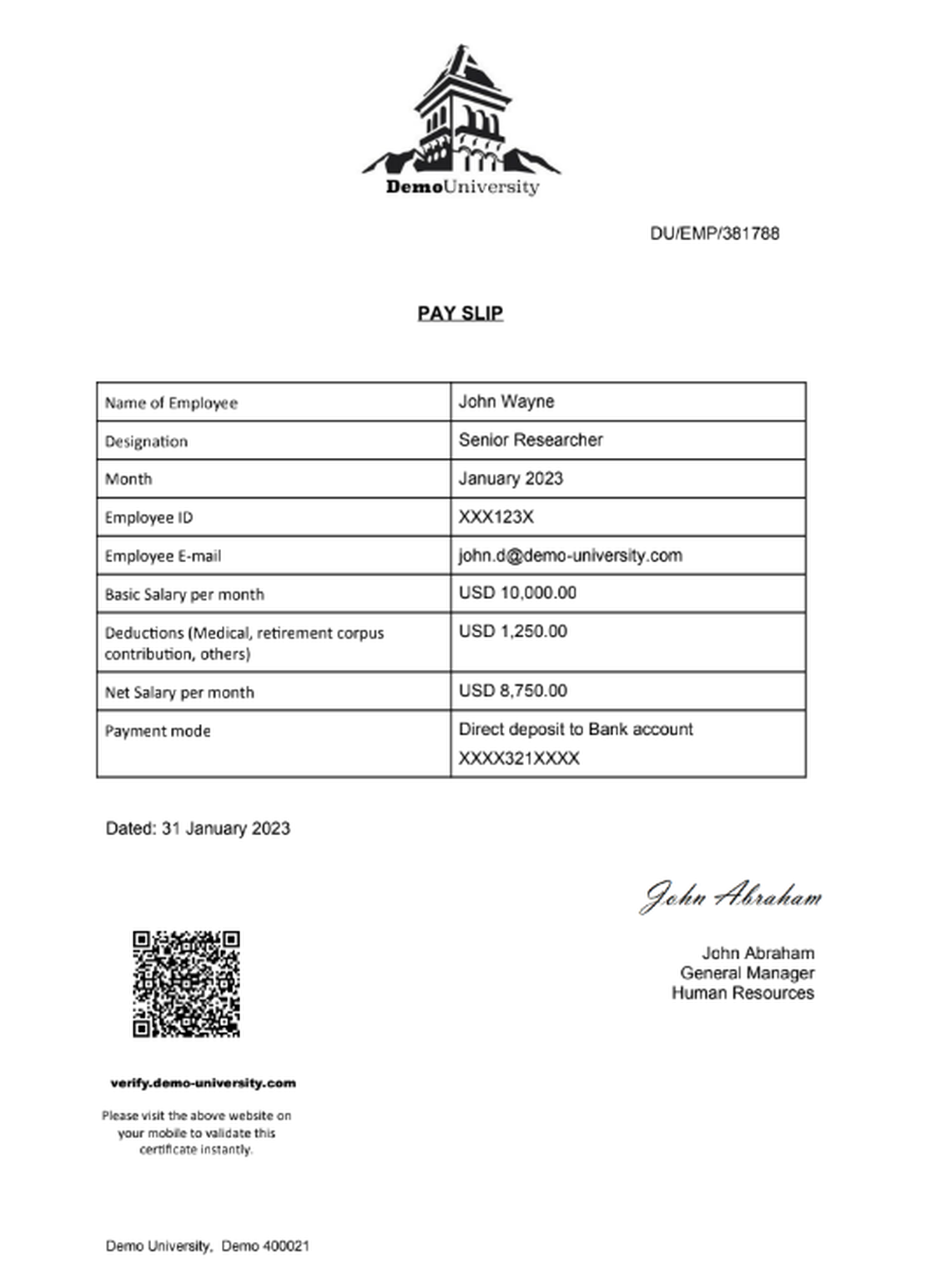

How does Qryptal work for this use case ?

The issuing bank would need to integrate with Qryptal for the issuance of secure bank account statements. There are two ways to integrate Qryptal into the workflow -

a) Manual - Staff logs on to web UI to get the account statement stamped with secure codes

b) Automated - Qryptal is integrated directly with the Statement Production System via APIs.

There is flexibility to move between the two - for example a Bank could start with the manual system and then move to an automated system depending on the volumes. Both workflows are also easy to incorporate as premium paid options for bank account holders.

For the customer to request for such a statement - there could again be a few options. They can ask the official at the bank branch directly or could login to the internet banking portal and make a request through a menu option there.

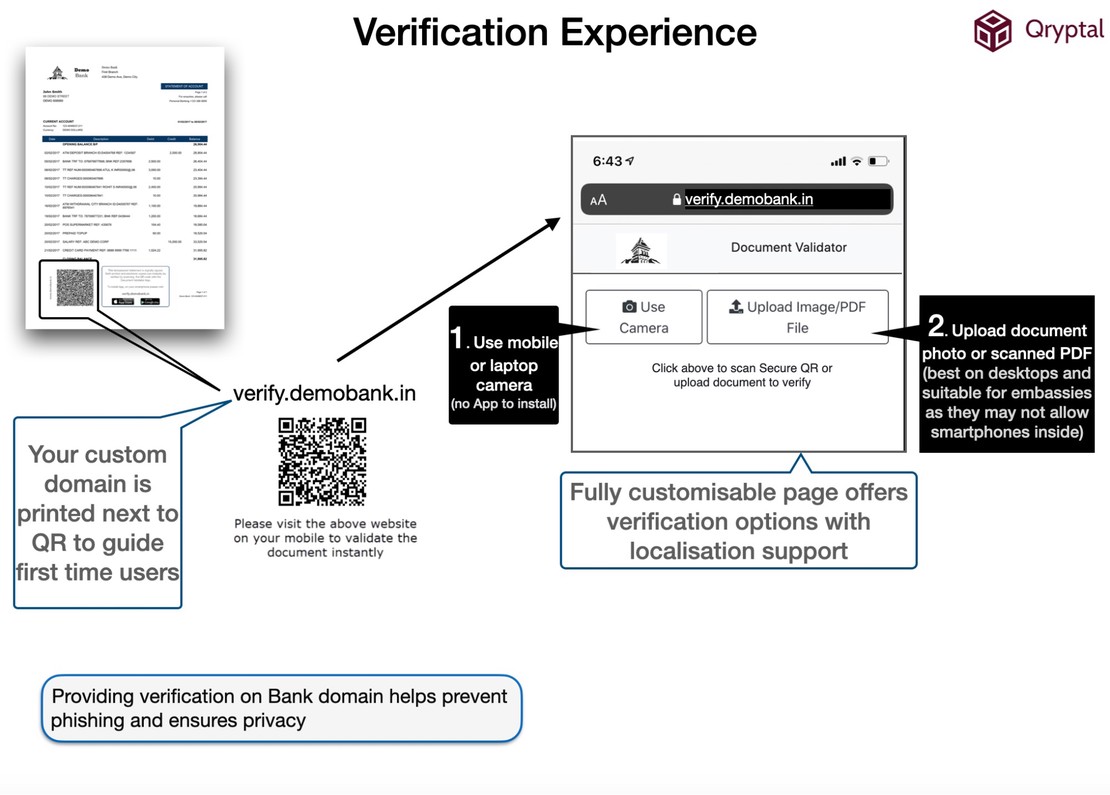

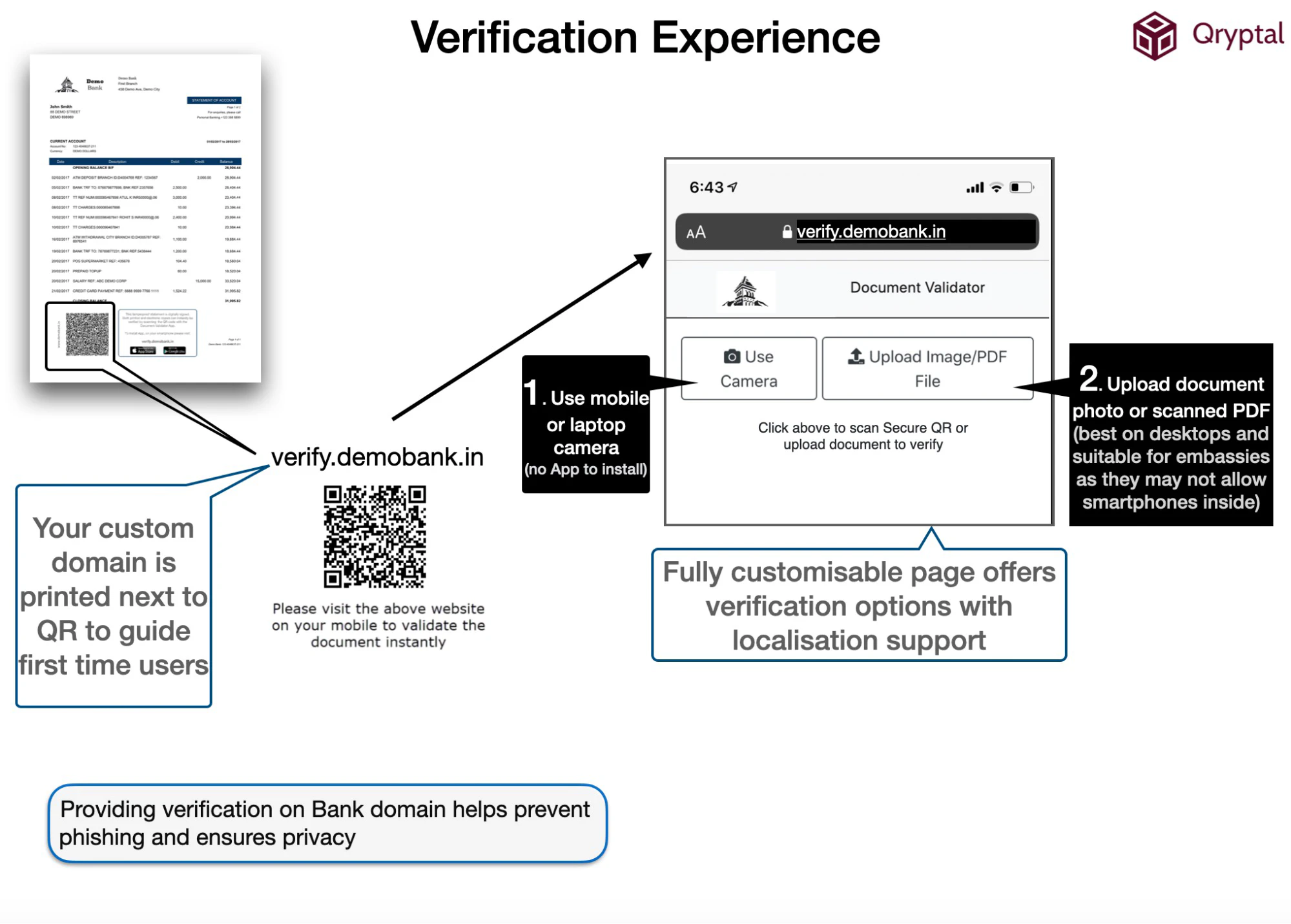

How would the visa issuing officers verify these account statements?

Officers would just need to visit the bank verification website (eg. verify.bank.com) powered by Qryptal. The verification website would offer 3 verification options:

a) Scan the secure QR code on statement using laptop or mobile camera without the need to install any App

b) Upload the scanned copy of the statement

c) If the embassy wishes to further automate, the verification server can be used to provide API tokens which the embassy’s back end systems can use to programmatically verify these documents without the need for any manual work by the visa issuing officer.

All the above options are easy and privacy friendly. It is a self-service model and removes all work load at the bank’s end for providing a verification service. This is also secure because no internal databases have to be exposed and no additional information is shared.

Easy Verification

Conclusion

Such a system scores highly on all aspects of Security, Privacy and Compliance.

No unauthorized code generation. Each code is digitally signed by the issuing bank’s private key.

No database dependency. The statement is stored encrypted in the ADR (additional database repository) and the QR code has a unique decryption key which is used to decrypt and show the information on scanning the code on demand.

The solution can be deployed on-premise or used over the cloud.

Only way to get to the document is through the QR code.

There is logging of generations and validations without logging client data. There can also be a system to notify the bank when the validation is carried out.

We suggest that the validation is carried out via authorised apps or web validation methods so that QR phishing and data capture by unauthorised QR readers can be avoided.

Suggested further reading

Immigration and Border Security

Securing HR Documents with Secure QR Codes: Real-World Use …

Integrating Sustainability and Financial Inclusion to Drive Africa’s …

The Changing Face of Document Security… - Qryptal