How to fix forgeries and fraud in Trade Finance documents

- Rajesh Soundararajan

- Oct 23, 2018

- 3 min read

Solve the problem of forged Trade Finance documents

With increasing global trade and flattening of the world, exports and imports between countries have become more common and the transactions have increased exponentially. This is a big area for most banks as they are a natural part of the trading ecosystem.

Trade Finance documents, like Letter of Credit or Bill of Lading, forms an integral part of commercial banking activity. It is the foundation or basis for international trade. Billions of dollars are being lent and credits approved based on these simple documents. Many downstream disbursements and debt financing depend on Trade Finance documents for credit-check and risk evaluation. Many recent examples in India and abroad have seen manipulations and forged statements that continue to play havoc with the bank’s credit system and ultimately the economy. Over the next few paragraphs, we will see how to address this issue.

Economic fraud involving forged Trade Finance documents is not new. While banks and loan disbursement systems keep tightening the process and security features, the problem continues unabated. The trade-off is two-fold. One is the cost of offering high-security Trade Finance documents versus benefits to the issuer. The other critical issue being the beneficiary of such a secure system would usually be a different division within the bank or in many cases may be another institution/organisation outside the issuing entity. With advancements in technology and increased stakes, even fraudsters have found clever ways of manipulation that result in significant losses for the banking industry as a whole. It has even eroded the credibility of the bank and the banking system at large. Hence the problem cannot be ignored.

Even though Trade Finance has a strict regulatory framework, there continue to be loop-holes in the system that the fraudsters find ways to take advantage of and they mostly resort to forging documents for a start.

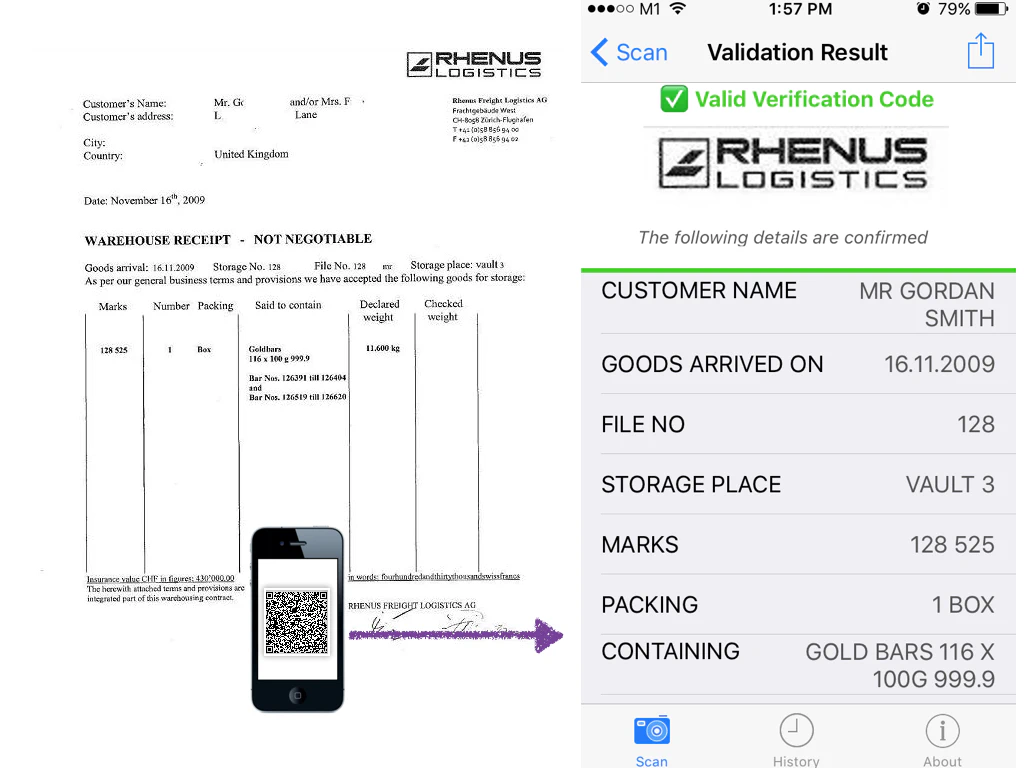

One way to tackle this is to add a QR Secure Code with critical details of Trade Finance documents stored inside a QR Code on the document itself. Cutting-edge technology similar to hyper ledger ensures that this high security, tamperproof code can only be created by the issuing entity, and yet can be manually or machine read across the spectrum in the ecosystem. The information inside the Secure Code can be cross-checked to validate the content. Most importantly the QR code is unique for ‘each’ Document because it is dependent on the contents of the document and can only be generated by the issuing organization. The technology can be easily integrated with the existing infrastructure and can handle the necessary processing volumes. Qryptal Secure QR codes for financial services are privacy friendly with no dependency on cloud and zero sharing of customer sensitive information.

[Sample Trade Finance documents with QR code]

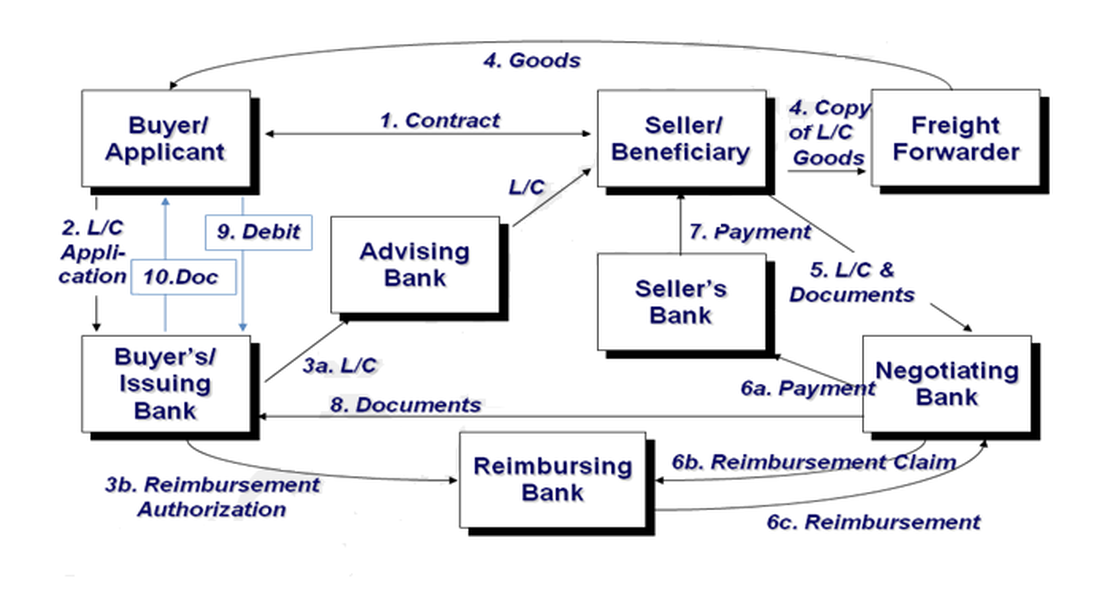

[Trade Finance documents processing workflow]

The QR code-based system is easy to implement and does not need a significant reworking of the current workflow of Trade Finance documents processing.

To know more, please write to info@qryptal.com, to request for the Banking Whitepaper that can help you prevent losses in Trade Finance documents.

Tags :

- Fintech

- Forged Document

- Trade Finance documents Fraud

- Trade Finance documents

- QR Code

- QR code financial services

- QR code payment method

- QR code payment system

- QR code mobile payment system

- QR code payment security

- QR code mobile payment system

- QR code digital payment

- Benefits of QR code payments

- what is QR code-based payment

- QR code payments how it works