Envisioning The Future of Fintech

- Rajesh Soundararajan

- Nov 22, 2022

- 4 min read

A New Growth Paradigm with Document Security

Any strategy for Fintech growth is built on the foundation of trustworthy financial transactions and an execution path towards achieving it. The rapid rise of Artificial Intelligence and Machine Learning and the volatility of cryptocurrency has put the focus back on the fundamentals of Fintech. In the race to introduce the ’new’ and ‘futuristic’ banking, Fintech must recognise how digital banking based on trustworthy document security can help deliver solutions aligned with growth.

The Fintech landscape is changing rapidly due to several factors. One of the most significant shifts is driven by growth principles in technology and infrastructure choices and support.

What does this mean in layperson’s terms?

Let us start from the first principle - A simple way of looking at Fintech is : using technology to improve financial transactions and provide better access to more people at lower cost.

There has to be a balance between the complexity of the technology to be used and the benefits provided to the target audience. Most times, simple technology can vastly improve existing processes and achieve desired outcomes rather than very complex, supposedly state-of-the-art and futuristic technology. There are many instances of failed implementations, loss of business, and even reverting to the old because the industry went in for the buzzword rather than try a simpler and practical approach which may even have been proven in some applications.

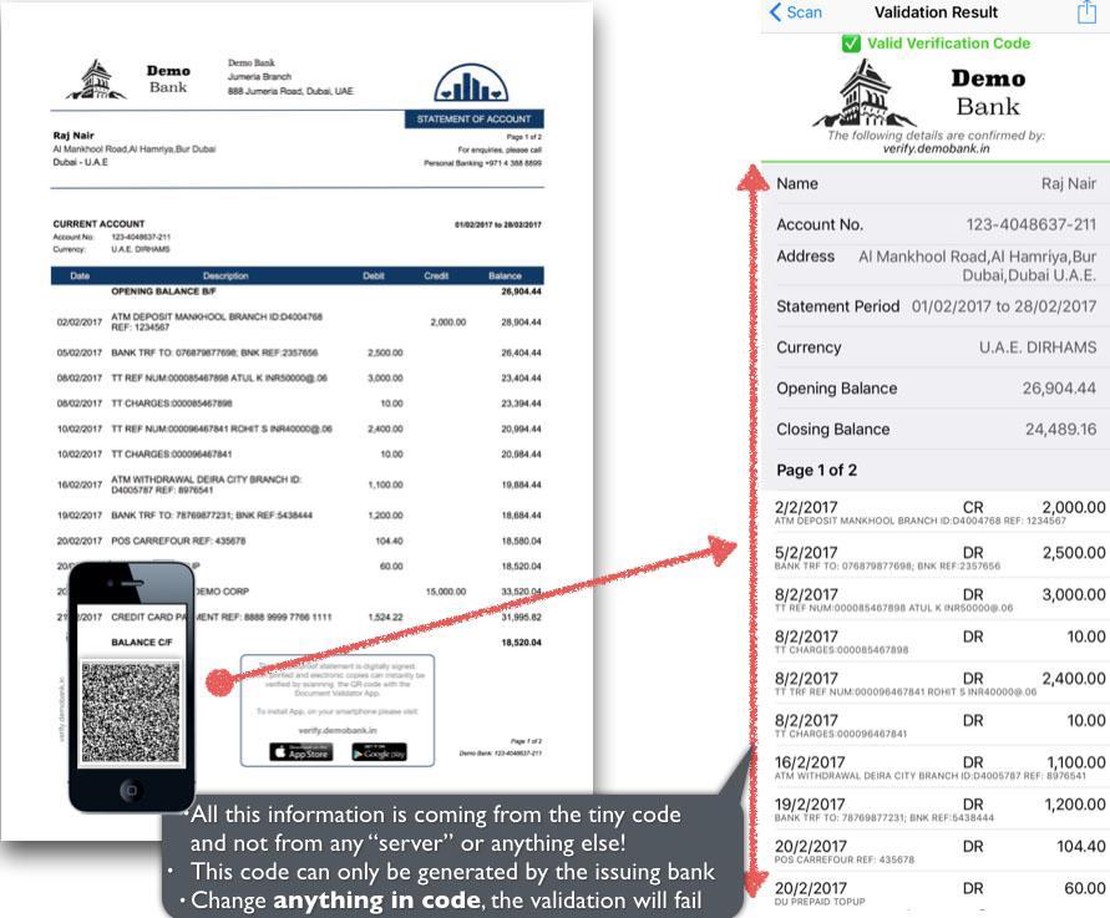

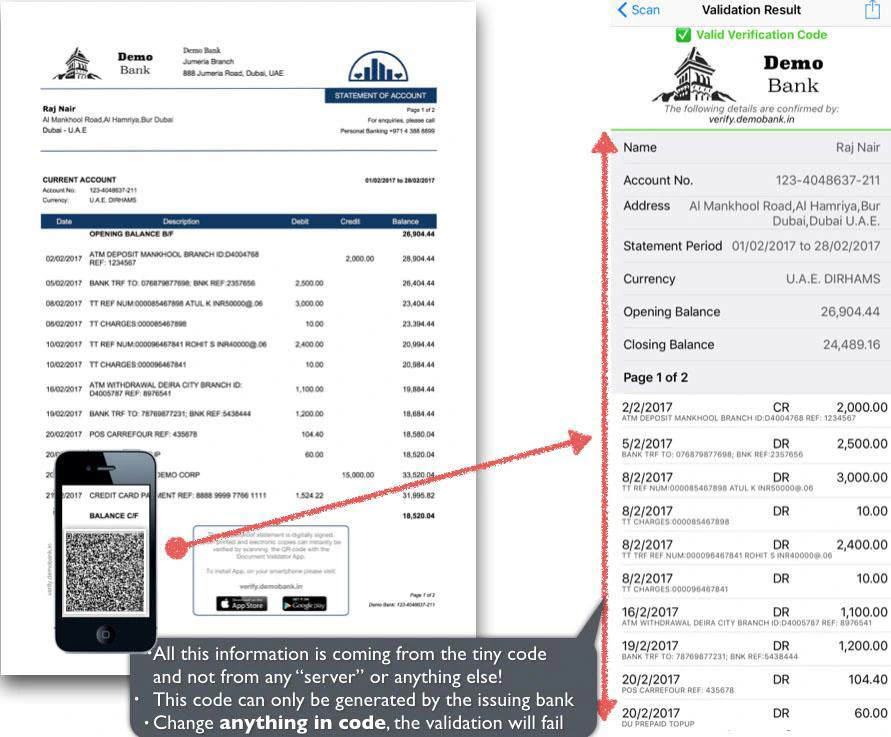

An example is the accelerated use of blockchain to prevent the forgery of simple account statements. Such decisions make for more complex implementations, and banks may lose millions of dollars with complicated integrations. An example of an account statement with secure QR as an alternative is given at the end of this article.

Factors influencing the choice of technology in fintech

There are various factors affecting the choice of technology for a fintech

- Security

- The total cost of implementation

- Integration complexities

- Addressing the broadest range of customers/ users

- Physical vs digital documents or both,

- Easy accessibility for its customers/ users

- Changing adoption patterns

- Quick, simple, and easy deployment

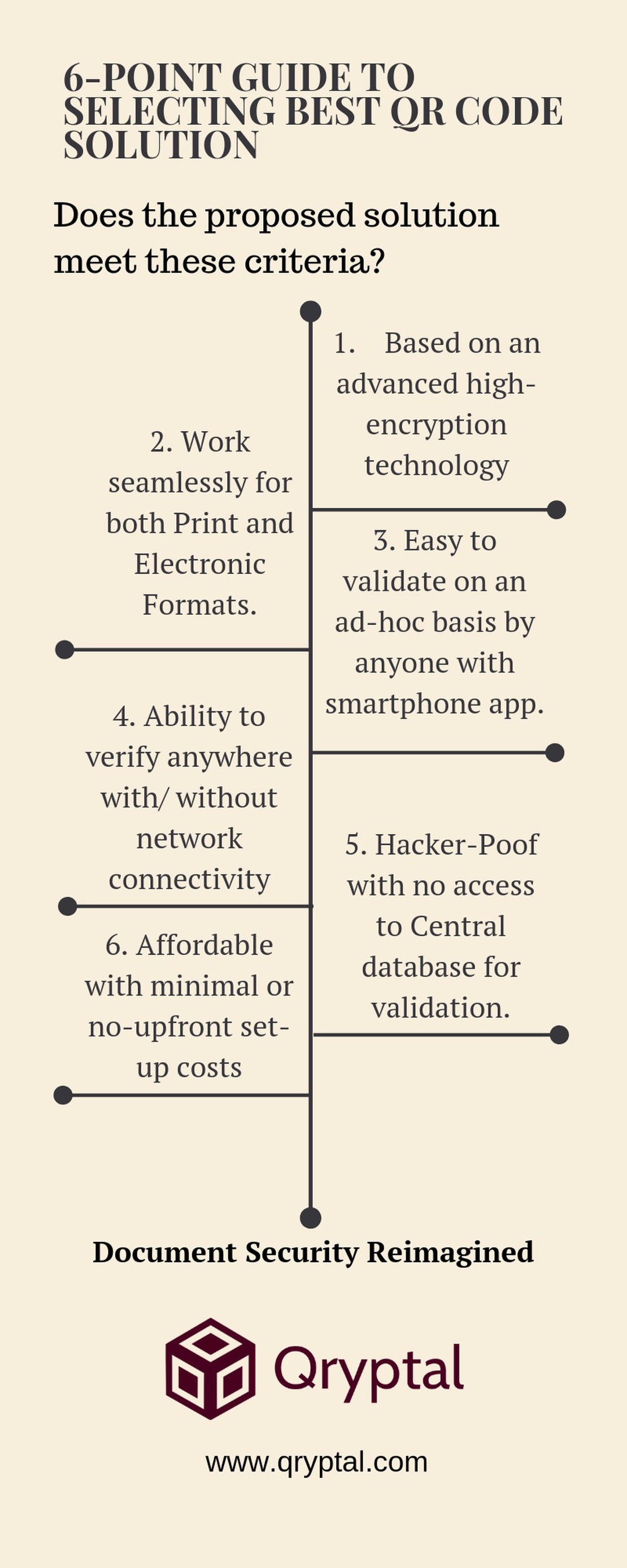

What should Fintech companies focus on to accelerate document security?

One of the most important things companies can do to accelerate trustworthy growth is reimagining document security. Document security is no longer a domain for high-end or complex B2B transactions. It affects every aspect of business and commerce, from cheques to payments to credit to loan sanctions. Towards this end, any work done towards reducing a transaction’s cost and having trustworthy transactions via a digital or physical medium directly impacts and increases participation resulting in the expansion of the market across all sections. In essence, the focus should be on -

A simpler-to-implement solution which can make the full deployment & implementation smoother and more widespread.

Reducing the cost of a transaction which directly impacts and increases the participation from the expansion of the market across all sections.

Working on and implementing ground-up technologies which would help the economic participation of the majority of society. The more complex hyper-ledger can also solve many of the problems. But at what cost and complexity is the question.

For example : We can use a simple, secure QR-based payment solution so that most of the population can access it. The other way in which Fintech can help is to maintain the same or enhanced security level with a feature phone or even a paper-based document without losing security. There are two sides to the Fintech coin: (a) expanding access and (b) providing a trustworthy and secure environment.

There are two sides to the Fintech coin: (a) expanding access and (b) providing a trustworthy and secure environment.

An example of an easy to validate account statement which can eliminate tampering

A simple document like an account statement is a classic example. An account statement is key to determining the net worth from visa approvals to loan approvals. The burden is on the customer to get the physical statement attested by the issuing bank. The example below solves this problem by having the statement stamped with a QR code securing detail. The code is added as an image using the Qryptal generator, and the same can be validated using the dedicated QR validator app.

Secure QR-based payments have already been successfully implemented in many countries. It’s simple, secure, and easy to use, so it’s ideal even for those unfamiliar with technology. Now Fintech must find ways and means of ensuring specific QR codes can be used in other ways, in all forms of the document for authentication and transaction processing.

You may also like

- Secure QR - Can Artificial Intelligence help detect Malicious QR Codes?

- Integrating Sustainable Financial Inclusion with Document Security

- Digitally Attested Documents

- Integrating Sustainability and Financial Inclusion to Drive Africa’s Economic Growth