Stop Fake Cheques - Don’t give away a Porsche !

- Rajesh Soundararajan

- Aug 18, 2020

- 4 min read

A simple QR code solution that saves millions of $$$

Stop Fake Cheques - Don’t give away a Porsche !

We live in 2020—the age of cryptocurrencies and internet banking. Yet, in this day and age, when we hear a Florida man buys a Porsche with a fake cheque printed from his home computer, it sounds incredulous. But that’s precisely what is happening across the world even to this day. Fraudulent cheques have been used for time immemorial, and this is a problem that banks are plagued with.

That we are talking about cheque fraud in an era of digital payments, so we need to look at the problem comprehensively and focus on appropriate solutions. This is not a problem limited to Florida, but a very real and a growing menace across the world.

The easy access to scanners, software, and printers, makes cheque printing at home as easy as 1-2-3.

In this post, we attempt to explain the problem of fake cheques and how banks can quickly solve the problem. With right technology in place, third-party validators like in this case - the car dealership or the Rolex salesman can quickly validate cheques with a simple smartphone with full privacy

Modus operandi of fake cheque fraud unraveled -

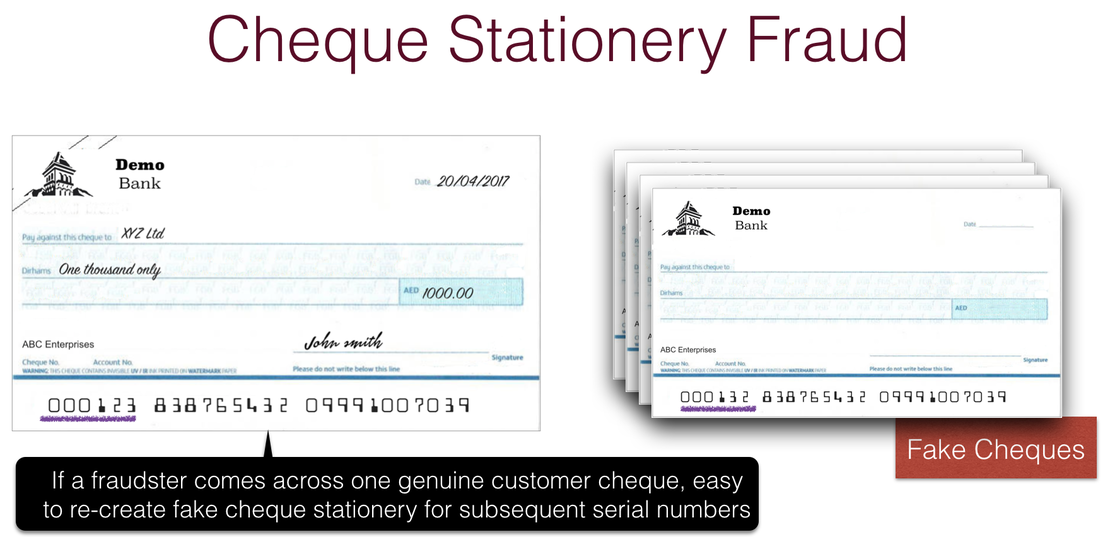

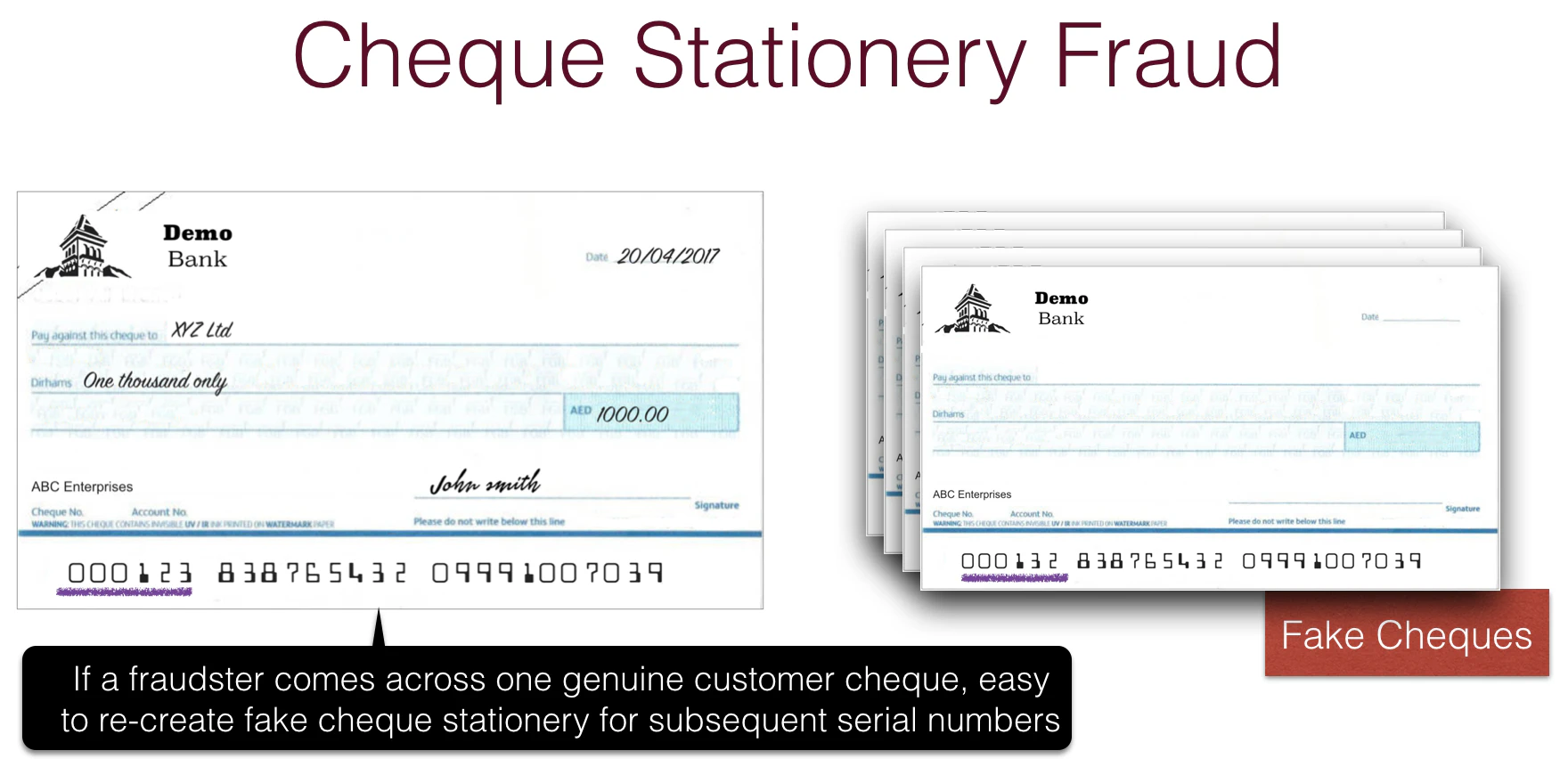

Each cheque leaf has a cheque number. The cheque book starts with a serial number which sequentially increases by 1 to the last leaf of the cheque book.

A fake cheque fraudster comes across one of your cheque numbers - say 000123 - and can easily recreate unused cheques like 000124, 000125, fill in the desired amount, forge the signature and thus encash such cheques. The unused cheque leaves may still lie unused in the original chequebook, but the fraudsters can create fake copies and encash them.

Cheque Stationery Fraud

The regulators and banks keep updating the security features and specifications, yet these incidents of tampered or fake cheques happen with unfailing regularity. The two key drivers for this are -

Motivation: Payoff is asymmetric- The potential gain can be huge, while the chances of getting caught are remote.

Access to technology: Sophisticated scanners, printers, and image manipulation software are now readily available to scamsters.

What then is the solution?

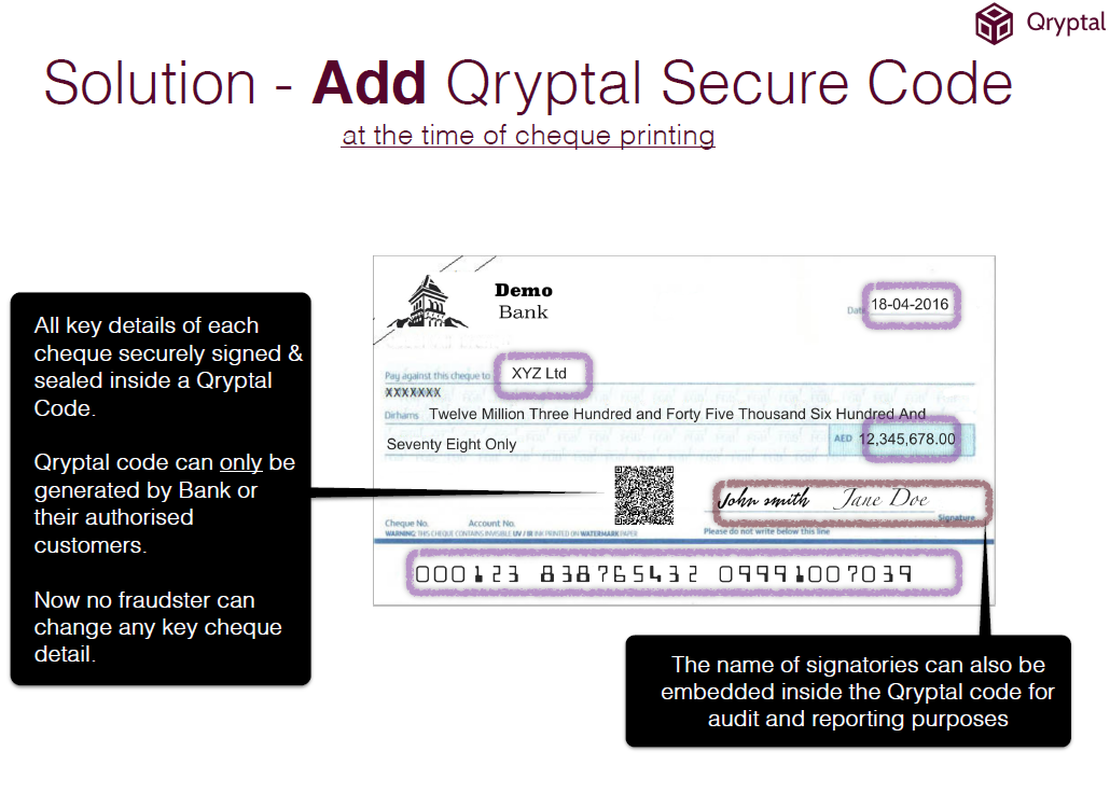

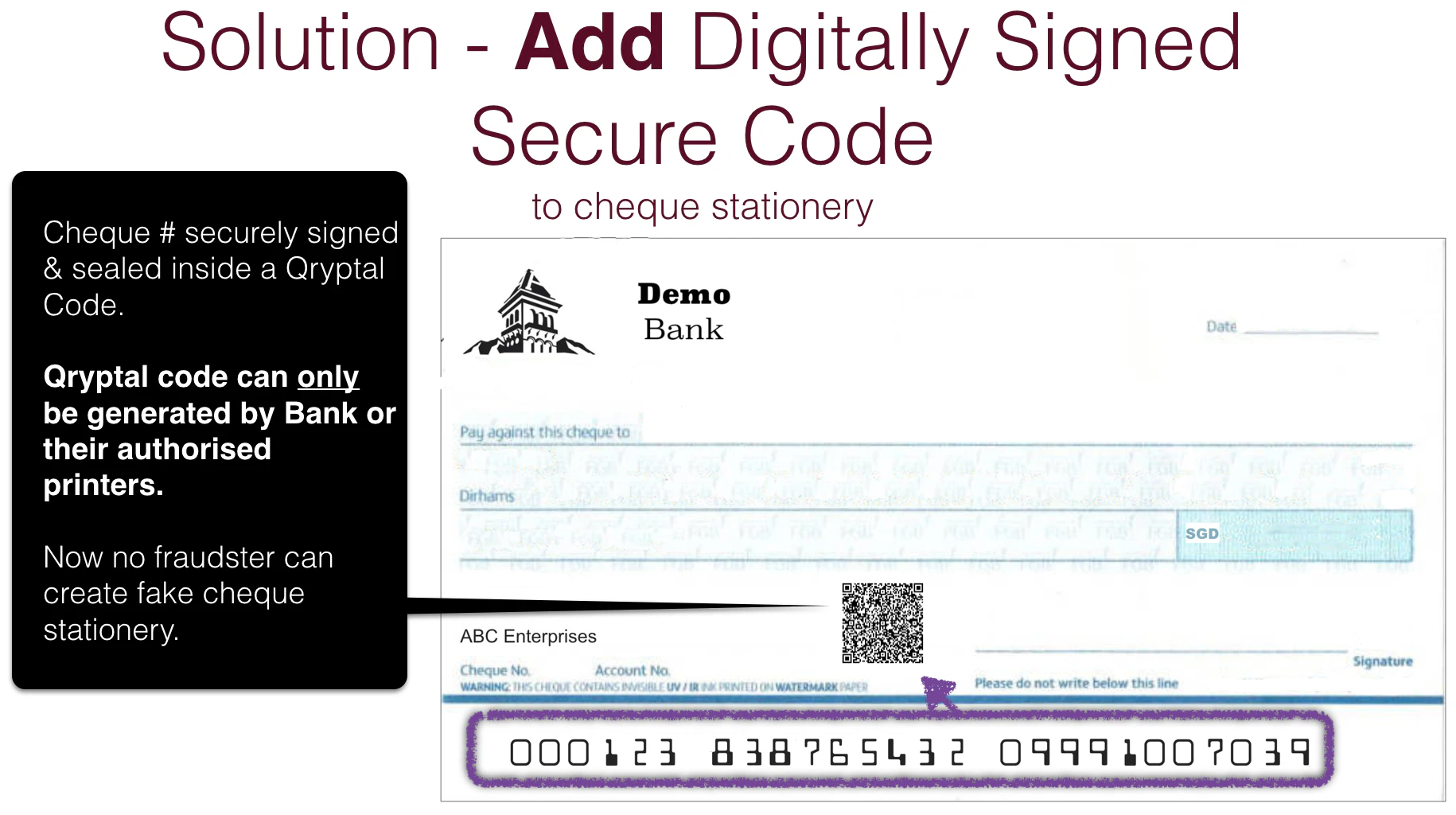

A Secure QR Code solution can address this problem efficiently. Banks print a secure QR code on each cheque with details such as cheque number, account number, and bank code captured inside the code at the issuance of the cheque book. Such high security and tamper proof codes can only be created by the issuing bank and digitally signed by their private key. No one else can create this code. Hence even if a fake cheque leaf is generated, the QR code on it cannot be created with the private key as only the original issuing bank has access to it and it can be easily found out on verification.

Sample Cheque with digitally signed Secure QR Code

The digitally signed QR Code on each cheque enables banks themselves or third-party validators to validate the information when they receive the cheques. They would be able to do that with a validation server, a web-validation domain of the bank or even a simple mobile app that has the corresponding public key to authenticate the cheque. This validation can be done instantly even before depositing the cheque or at the time of receiving the cheque image in clearing.

In this case, the Porsche or Rolex dealer would have been able to authenticate the cheque instantly on receipt and need not have to wait for the bank to confirm. In fact, they could have alerted the authorities of the receipt of a fake cheque.

This secure QR code-based system for cheques thus fulfils the following the functions :

1. Easy to validate on an ad-hoc basis: Anyone with the specified smartphone app can validate the cheque/information anywhere – online or offline.

2. No need to Access Central Database: It completely avoids Central Database or network access for validation thus making it efficient and keeping the IT systems secure and hack-proof.

The next time you think about tamper-proofing cheques, Secure QR code helps you achieve that with efficiency and effectiveness.

You may also like

The world’s banking industry incurs an annual loss of $10 billion due to cheque fraud

Ten surprising uses of QR Codes in the industry that you may never have guessed