Prevent Cheque Fraud using Secured QR Codes

- Rajesh Soundararajan

- Jan 30, 2019

- 4 min read

A massive cheque fraud industry causes billions of dollars in losses each year - Secure cheques with Document Security QR Code

Stop Fake Cheques with Digitally Signed QR codes

It may sound ironic that we are talking about cheque fraud in an era of digital payments, yet this problem is very real and a growing menace in India and across the world. As per RBI Annual Report 2017, the volume of paper clearing (cheques with CTS, MICR, Non-MICR) stands at a staggering 1,206 million instruments, transacting over INR 80,958 billion in 2016-2017. And a simple search for news on Cheque fraudwill throw up results that will explain the magnitude of the fake cheque problem.

Here is a quote from a recent news story highlighting the problem

News Story Involving Fake Cheque

With easy access to scanners, software, and printers - it is not surprising that cheque fraud is rampant. There are two kinds of cheque frauds: fake cheque fraud and tampered cheque fraud. This post explains the problem of fake cheques and how banks can easily solve the problem for themselves and empower the public to easily validate cheque stationary with just a smartphone with full privacy. We will discuss about cheque tampering frauds in a future post.

What is fake cheque fraud?

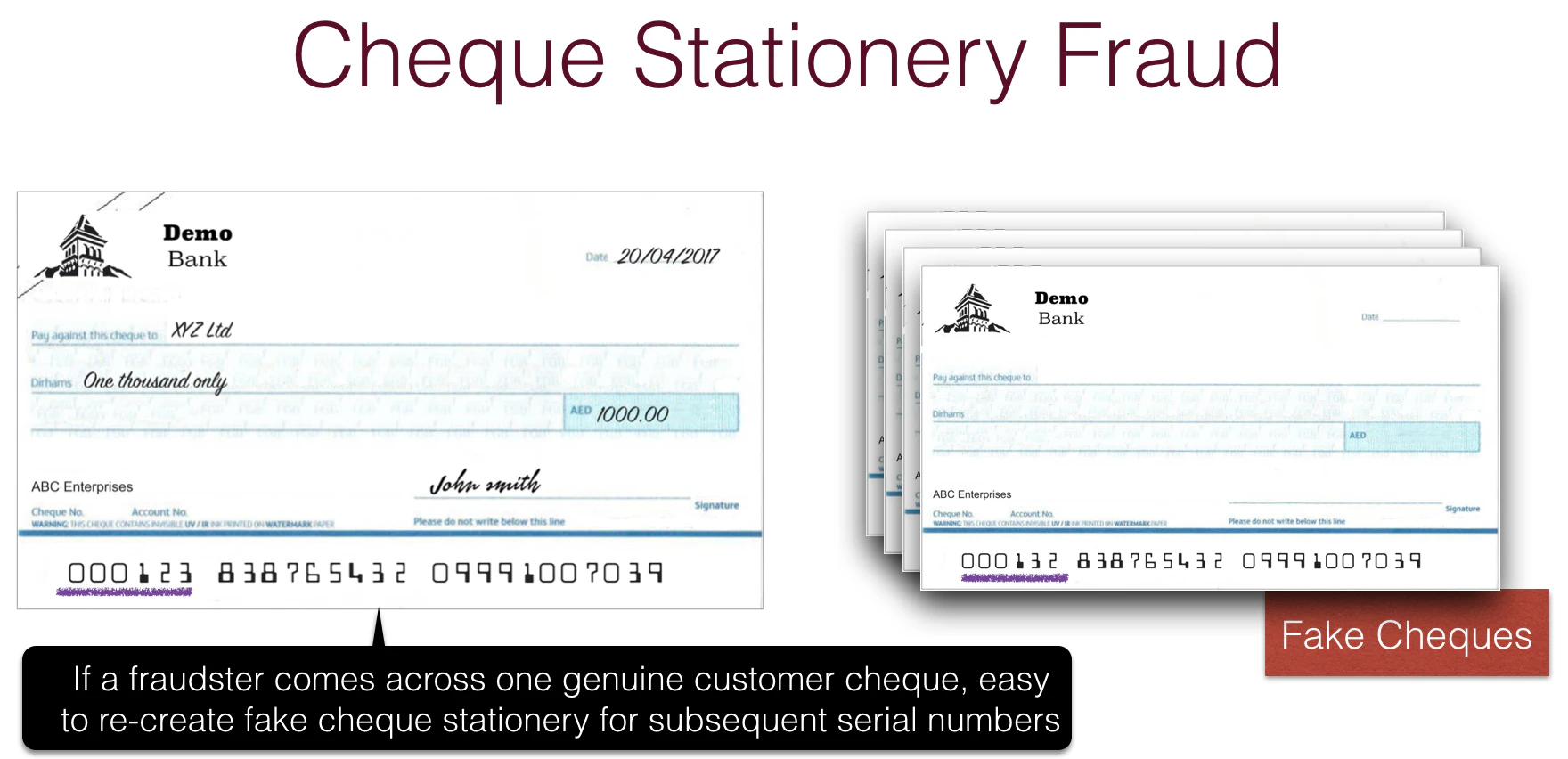

If you open your cheque book - you will see that usually the only difference between each leaf is the cheque number. So - say first cheque number (at the bottom left) is 000101 then subsequent numbers would be 000102, 000103…000150 for a 50-leaf cheque book.

The fake cheque fraud occurs because if a fraudster comes across your cheque number 000123 - he can easily recreate your unused cheques like 000124, 000125…000150 etc. The fraudster can then encash such cheques via various means which makes it difficult to trace back to the fraudster. So, though you may still have the unused cheque leaf 000132 in your cheque book, but the fraudster is able to create a fake copy and encash it.

A Sample Cheque

Despite the best efforts of regulators and banks to keep updating the security features and specifications, incidents involving fake or manipulated cheques occur with increasing regularity. The two key drivers for this phenomenon of increased number of fraudulent cheques are

Motivation: Payoff is asymmetric- The potential gain can be huge, while the chances of getting caught are remote.

Access to technology: Sophisticated scanners, printers and image manipulation software are now easily available to scamsters.

The economy pays a heavy price for this manipulation, each time that a fraud happens.

What then is the solution?

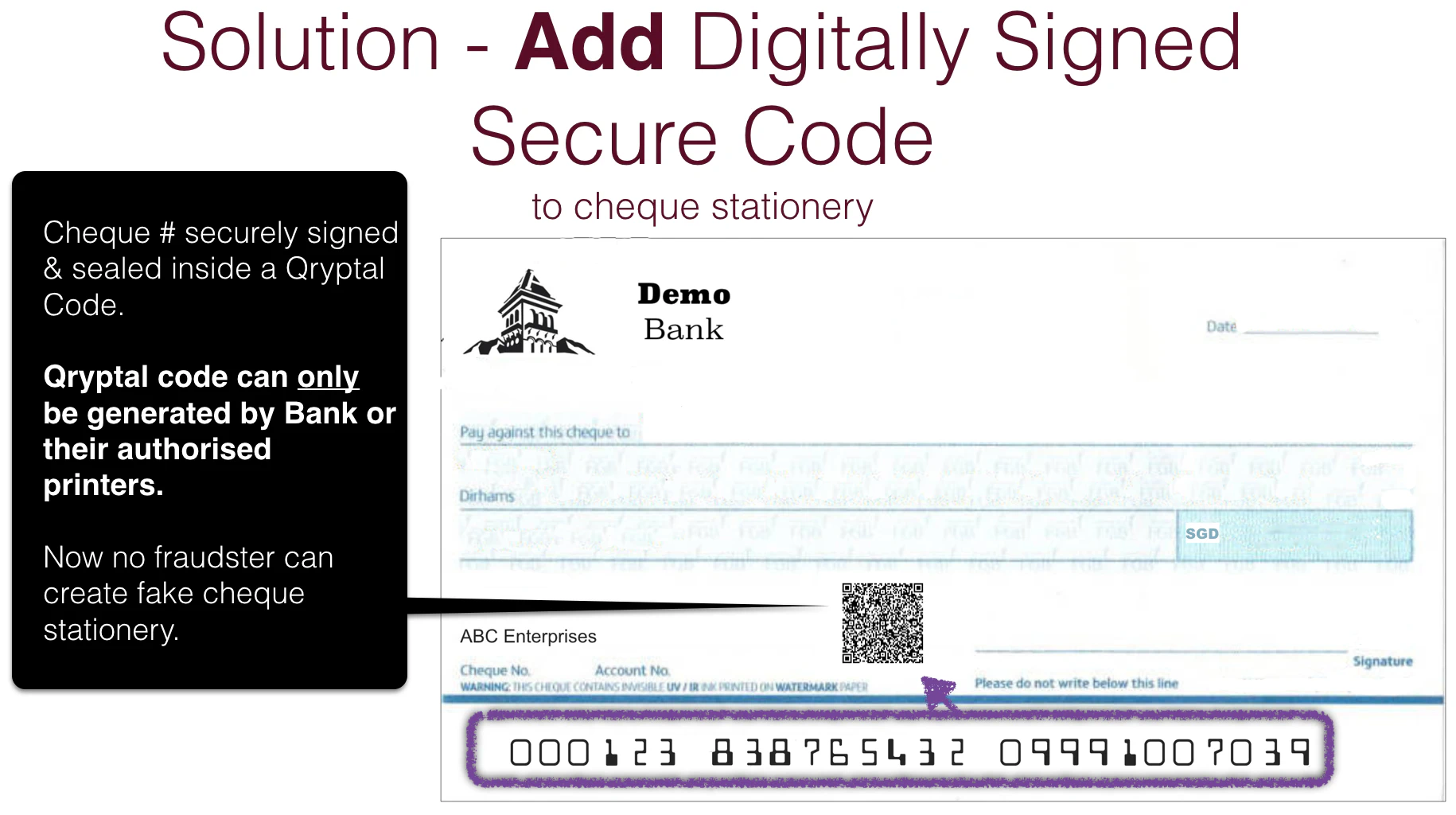

The solution can be surprisingly simple. With rapid strides in document security QR Code, securing a document (including a cheque) with a QR code is simple, efficient, and affordable. The solution is based on a cutting edge technology that enables secure QR code integration to protect both printed and electronic documents. A Secure QR Code with details such as cheque number, account number and bank code stored inside is added to the cheques at the time of issuance of the cheque book Such a high security, tamperproof code can only be created by the issuing bank and is digitally signed by their private key. No other person can create this code. Hence even if a fake cheque leaf is generated, the QR code on it cannot be created with the same information inside.

The Secure QR code is smartphone or machine readable and the information inside can be cross-checked with the MICR information to validate the cheque and identify the fraudulent ones. Most importantly, as explained, the QR code is ‘unique’ for each cheque and can only be generated by the issuing bank. Further, this technology can be easily integrated with the existing infrastructure and can handle the necessary processing volumes.

A digitally secure QR code enabled cheque

There are other ways of adding security like printing a random number on the cheque (in digits or inside a QR Code) but such solutions do not enable the public to also be able to validate cheque stationery. The digitally signed QR Code is an elegant technology which enables not just the issuing bank to catch fake cheques but also empowers other banks and the public to validate when they receive cheques from other parties.

The solution thus offers the following benefits -

Easy to validate on an ad-hoc basis: Anyone with the specified smartphone app can validate the document anywhere - online or offline.

No need to Access Central Database: It completely avoids Central Database or network access for validation thus making it efficient and keeping the IT systems secure and hack-proof.

So, the next time you are looking to issue tamper-proof cheques or other secure documents, Document Security QR Code could be your answer. We are increasingly seeing such customer friendly technology being adopted by banks and financial institutions across the world.

This article first appeared in Times of India on January 29, 2019.

You may also like