Why do banks lose millions because of the Purchase Order scam ?

- Rajesh Soundararajan

- Sep 03, 2019

- 3 min read

And what can they do about this

How and why do banks lose millions because of Tampered Purchase Orders scam?

Recently, we shared an article on how several retailers/suppliers are duped by fraudsters using fake purchase orders - link here - Massive Purchase Order Scam hits suppliers. The story, unfortunately, does not end there. Such a scam spreads across to other entities like banks too.

Increasingly banks and financial institutions are coming across manipulated purchase orders and invoices. The way it works is usually very simple. Some companies (typically small suppliers to an anchor/large reputed company) do manipulate the invoices and purchase orders to get higher loans and overdraft facilities or even for bill discounting. The banks, as you can imagine, on seeing a purchase order from a large company, readily extend such facilities and credits to the small suppliers, secure in the knowledge that their money is safe as the anchor company will pay the required amount when due.

This activity continues undetected for individual purchase orders and very soon these borrowers, have run up big amounts of bill discounting or borrowed large sums or taken large overdraft facilities. At some point, there is a mismatch in the amounts due and realized and that’s when this comes to light. Either the anchor company is held responsible and has to pay up the difference or the banks are left with huge outstanding/unrecovered loans, primarily because they did not extend credit after due checks and/or relied on documents which could be easily manipulated.

What can banks do to prevent such losses & How do we stop being a party to such scams?

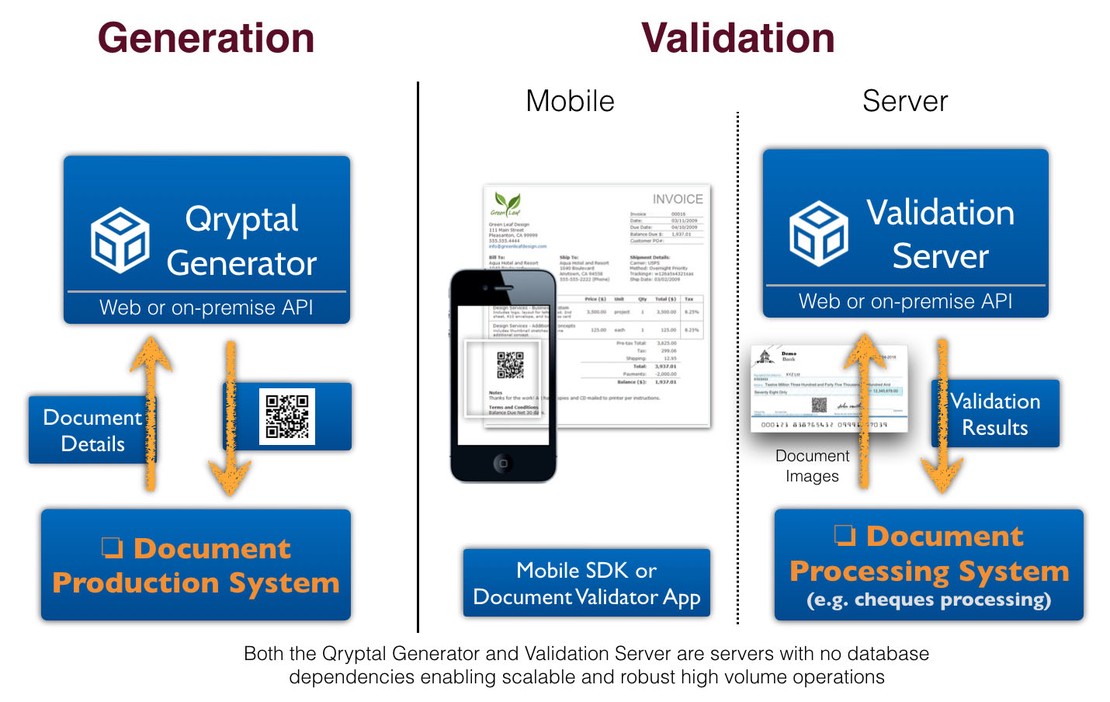

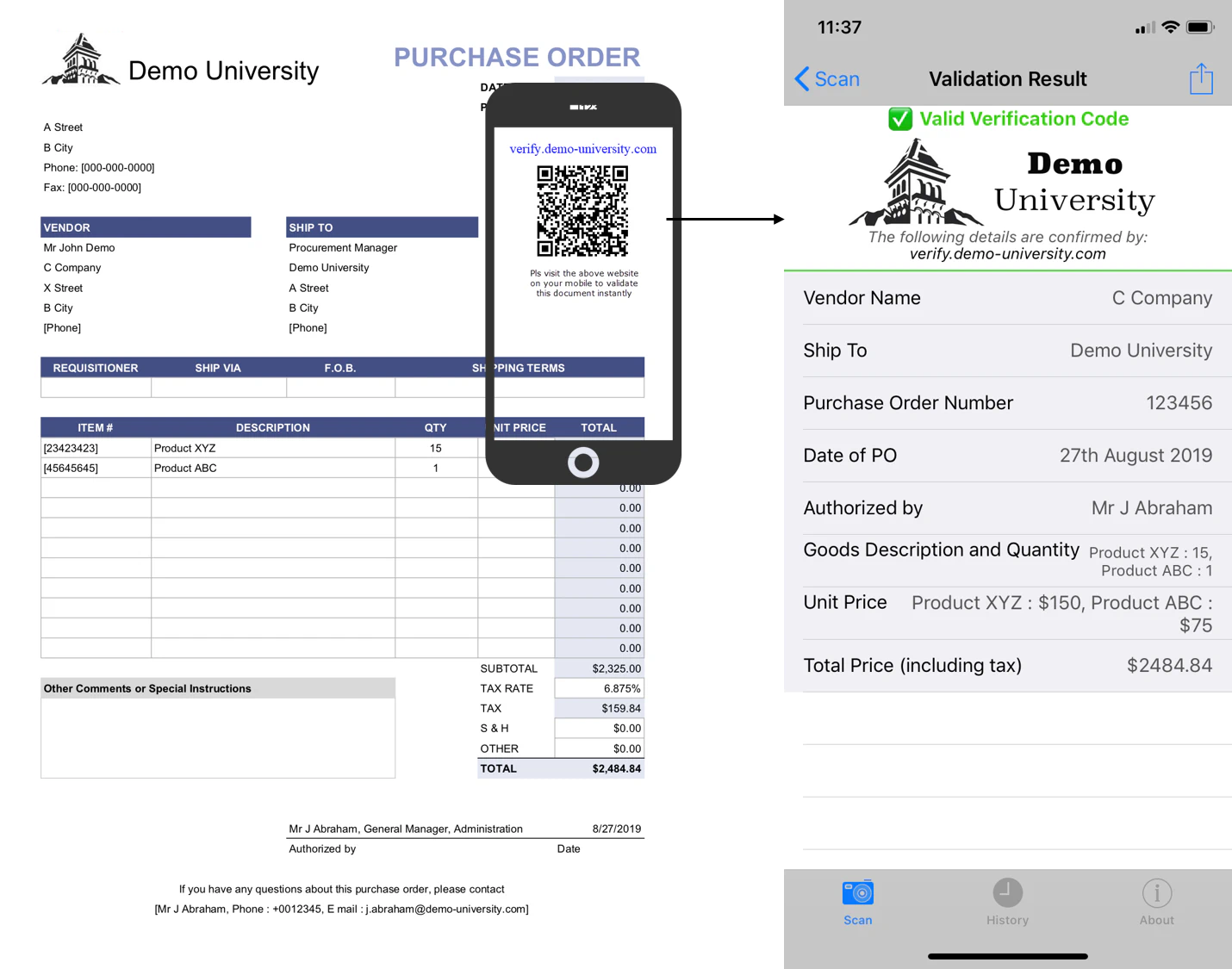

A simple, effective way is to ensure that all such documents carry a secure QR Code (containing relevant critical details) which is generated by the companies issuing the documents/purchase orders so that no one can tamper or manipulate the information without being detected. These can be verified by banks themselves using a simple smartphone with an app. Such QR Codes, cannot be tampered with or the data in them cannot be altered. Consequently, all bogus purchase orders and invoices would be detected and highlighted at the very first point, preventing significant losses to the bank and protecting the reputation of large companies dealing with a host of small suppliers who are not as creditworthy on their own.

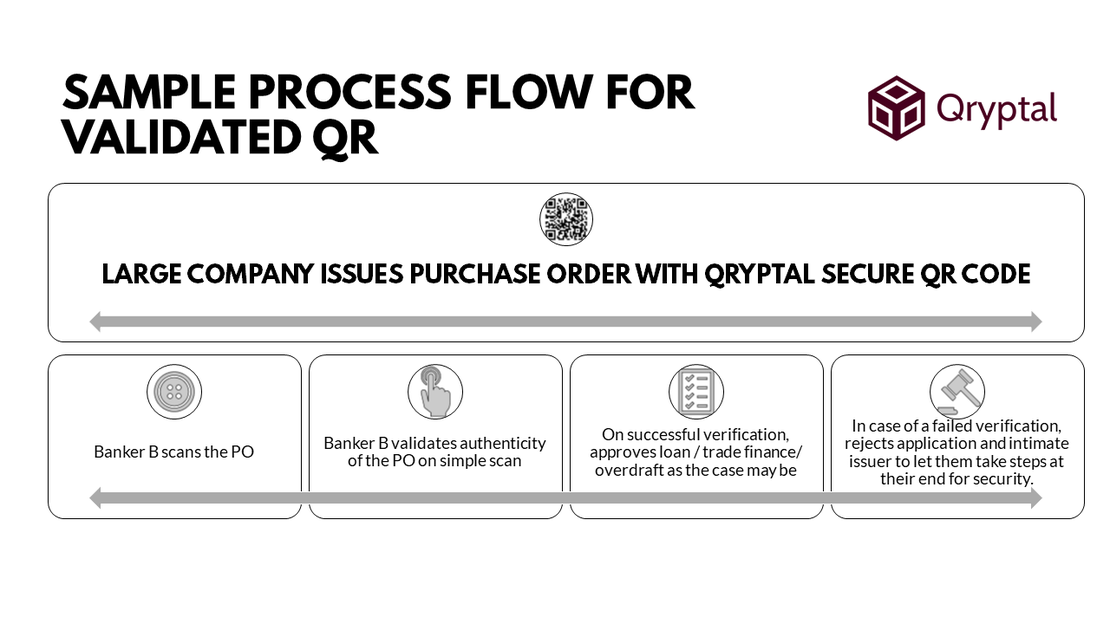

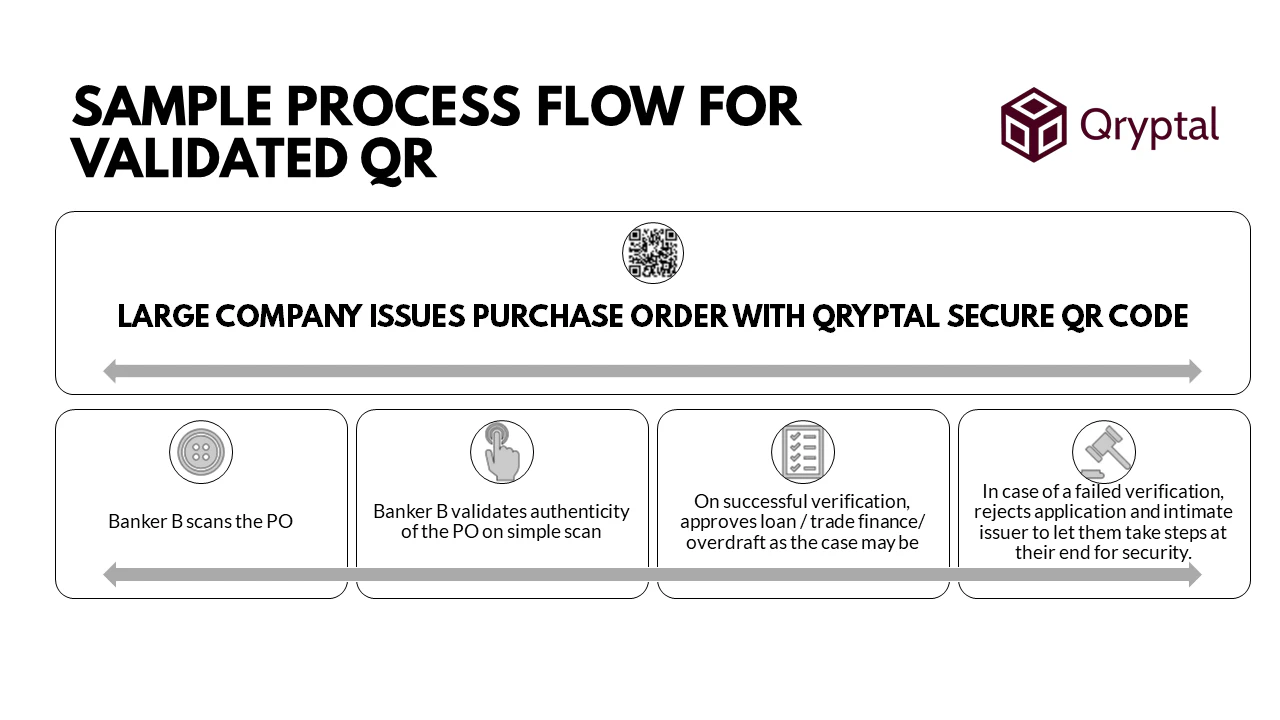

Sample Process Flow

The simple system works as shown below

Since such secure QR code-based systems work both online and offline, they can be used for instantaneous verification without the need for any elaborate systems integration or setups. A sample flow diagram is given below.

University Purchase order with Secure QR code

You may also want to read

- FBI and Singapore Police unearth the modus operandi

- How can you stop fake ticket rackets?

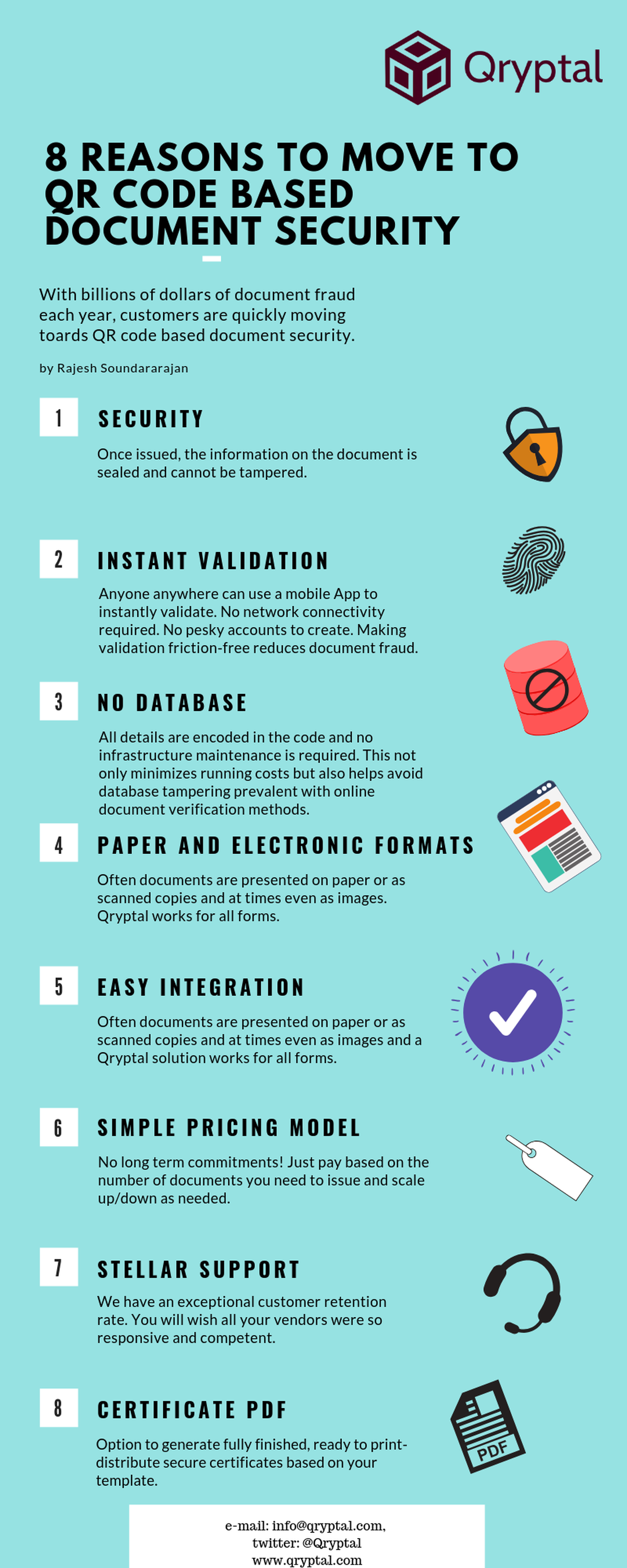

- Infographic: QR Code Based Document Security

- How QR code technology works