Secure & Easy way to prevent Insurance fraud

- Rajesh Soundararajan

- Mar 12, 2019

- 5 min read

Are you a victim of Insurance Policy Fraud?

Are you a victim of Insurance Policy Fraud? Here is how you can tackle it.

Insurance fraud occurs all over the world, and especially in motor vehicle insurance, such fraud is rampant.

The ‘imposter’ agents who sell insurance often use templates of reputed companies and are open to giving discounts that make the policy cheaper which lures the unassuming victim. On making payment, the insured receives a copy of the insurance certificate either directly from the agent or in a strikingly original looking envelope. Since this modus operandi uses certificates that resemble the original, the insured would not usually bother to check the validity of the document. They will assume its genuine and keep it for use as they normally do.

CRIME BRANCH: Police bust motor insurance racket - Mumbai Mirror

Even where a law-enforcement officer verifies, they usually have a physical look at the certificate. They don’t have any other mechanism to check if its authentic. Such fraud can remain unnoticed for years unless there is an insurance claim event.

This causes multiple problems. At the bare minimum, it is illegal for the owner of the motor vehicle to have a fake document, as he/she is solely responsible for having and maintaining valid insurance. This can also lead to complex legal hassles in the event of an accident since the insurance is not valid, to begin with, and hence there cannot be any claims made for own damages or for third-party liabilities.

This fraud is widely gaining popularity with fake agents having access to technology that can print a high-quality document of reputed companies from expired insurance documents. These imposters can replicate renewal letters, as well as the insurance policy document that makes it seem original. Today, with the mushrooming and outsourcing of policy related & renewal calls to call centres, there is easy access to the database of expired insurance policies or renewals. This has led to a significant increase in sophisticated frauds leading to losses of billions of dollars, not just for the insurance companies, but also affecting the insured.

Enter Tamperproof and Secure QR Code embedded Insurance Policies - The surest and simplest way to Stop Insurance Policy Fraud

A solution to such a complex epidemic is rather simple. All major insurance companies can adopt a QR code-based document security solution approach, where the company prints a simple , tamper proof and secure QR code on the insurance document that is easily verifiable by anyone with a smartphone and a dedicated or authorised App. This can be done for both electronic and physical document formats and any third-party would easily be able to validate the authenticity of these documents online or offline.

Insurance Certificates already have regular QR Codes. What is the problem with those ?

In many countries, regulators have mandated QR codes on policy certificates that have met with at best, a ‘theoretical’ compliance. These non-secure QR codes did not solve the problem of tampering (as anyone can generate them) and in fact, have accelerated the problem by giving a false sense of security.

In practice, insurers are putting either static non-secure QRs with all the policy information (which is easy to change) or even worse, they are embedding a URL inside such a QR which not only compromises security but also exposes users to phishing attacks - Read our earlier blog on placing URLs in QR codes

In short, that non-secure QR having an embedded link opens directly using the regular QR code reading apps and hence it is difficult to discern the page URL. Since the page opens normally within the app itself - the regular browser-based protection mechanisms are not triggered

How is the Qryptal Secure QR Code different?

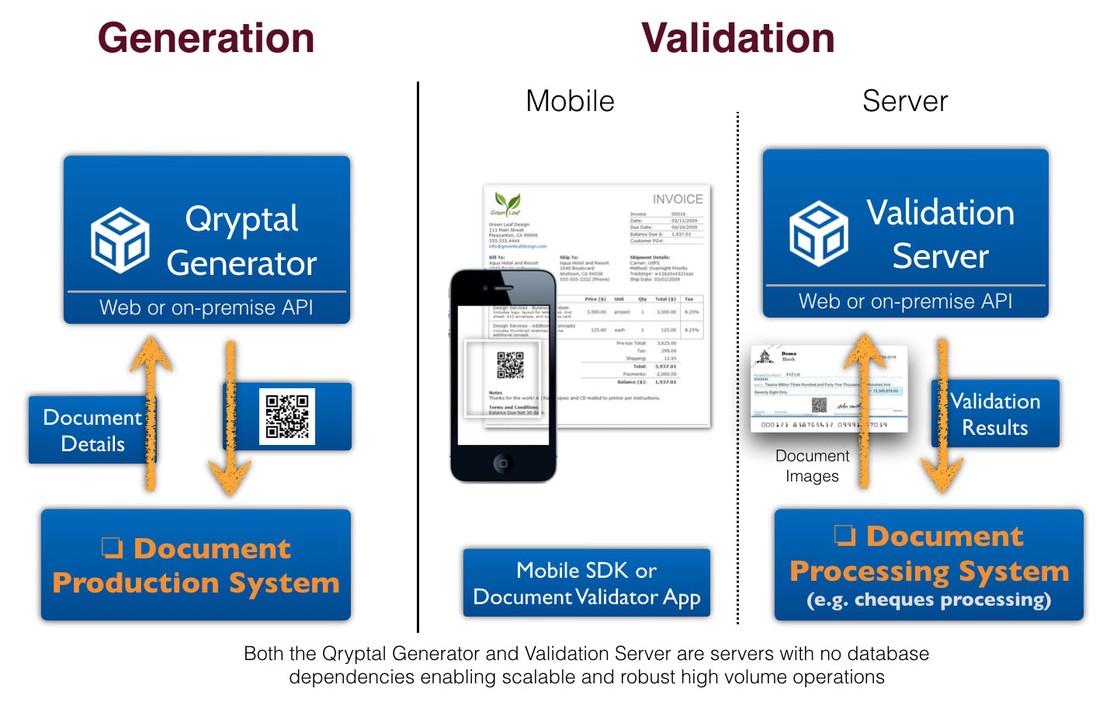

Our proposed secure QR solution has two components

Has a document generation system which generates secure documents that can only be done by an authorised issuer. Hence it helps to prevent unauthorised manipulation or tampering.

An easy and simple mechanism to validate such policy documents that can be easily used by third-parties to authenticate and trust the information

Secure QR Code based document generation systems like Qryptal tackle this problem by making sure that all such documents are system generated centrally and the information on them is captured in the form of a Qryptal secure QR code before it gets printed either physically or electronically. In addition, the QR code will have the digital signature of the issuing organisation so that unauthorized modifications can be identified and stopped.

This can be then validated by different stakeholders to whom it is presented (service providers for claims processing, banks for loan applications etc) with the help of an authorised app or a validation server and the verified contents can be used for the purpose required with full confidence.

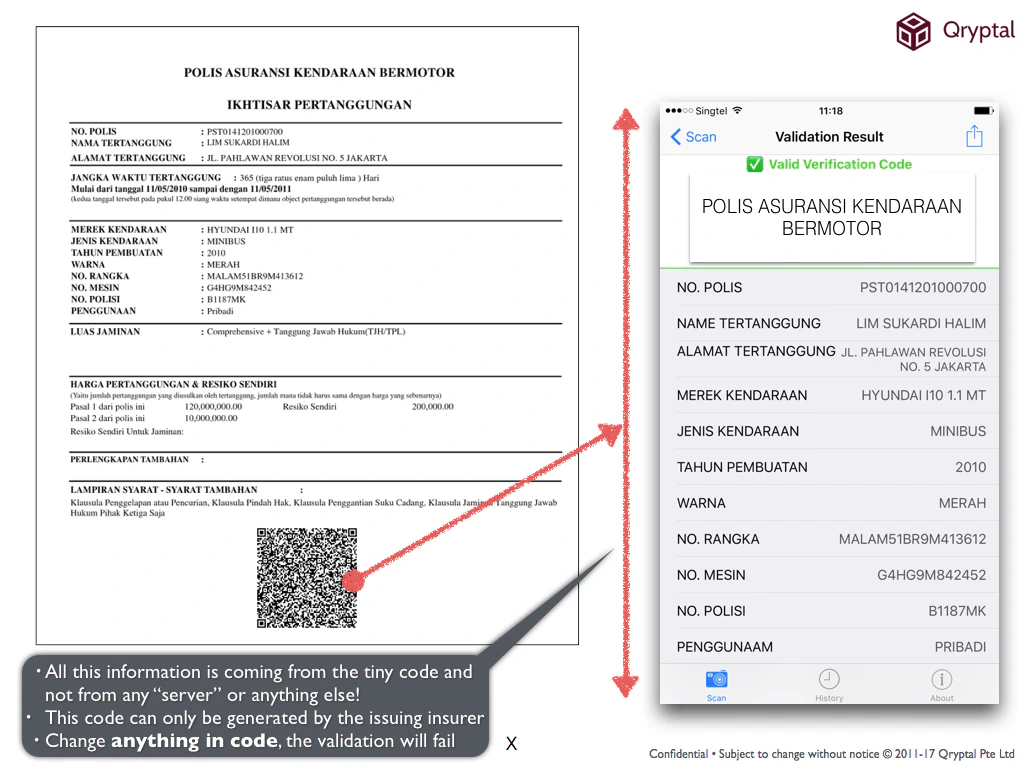

A sample of an Insurance Policy with a QR code encapsulating the details is shown here. On scanning the code all the details contained inside it is visible for verification.

Secure QR code verification for insurance policy using such a system offers significant benefits

It works for both printed and electronic documents

The secure QR code can only be generated by the issuing organisation and cannot be faked or tampered by anyone else It allows self-service verification of documents by third parties

There is no URL - this helps to prevent phishing attacks which is a risk with regular QR codes as explained earlier

Strengthen personal data protection as information is accessed through the QR code and using an authorised app only. Also, since the information is stored inside the QR code, there may not be any requirement to get into tripartite information sharing issues

Data domicile issues may be minimal as no online infrastructure is required

You may also be interested in the related articles

How to Verify Insurance Policy Documents and Avoid Fake Insurance Scams

How does one tell if passports and visa documents are genuine?

How does this Secure QR solution work?