Cheque fraud prevention measures

- Rahul Sinha

- May 23, 2017

- 3 min read

An elegant solution to address the problem of fake Cheques

Much as it may sound ironic that we are talking about cheque fraud in an era of high technology and instantaneous payments, this problem is very real, even in today’s world. Cheque fraud can take several forms — counterfeit/ fake cheques, altering beneficiary details fraudulently or genuine cheque with a forged signature. In this article, we will mainly focus on the first problem of counterfeit or fake cheques.

Incidents involving fake cheques occur with regularity, while banks and regulators keep updating the security features and specifications to identify genuine cheques. With advancements in technology, even fraudsters have upped the ante. Hence, there have been increasing cases in recent times which have not been detected through the regular scrutiny and processing and have therefore resulted in significant monetary losses for the banks and account holders. Although it may appear on the surface to be a minor issue, it has already resulted in a hit to the bottom line and in some instances even eroded the credibility of the bank and the banking system at large.

Let’s look at some instances

http://www.startribune.com/minn-bank-official-teller-among-28-charged-in-check-fraud-case/280683322/

Typically, the cheques issued by banks have to comply with strict guidelines in terms of embedded security features as well as steps to be followed during the processing. But the fraudsters also have access to sophisticated technology which can replicate most of these features on counterfeit cheques and make it impossible to distinguish between the original and the fake especially in image-based cheque processing. It is also possible to get the signatures of the original account holder through underhand means so as to pass through that checkpoint too. But, technology is a double-edged tool — and also provides a way to address this problem!

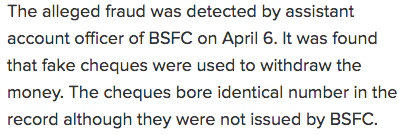

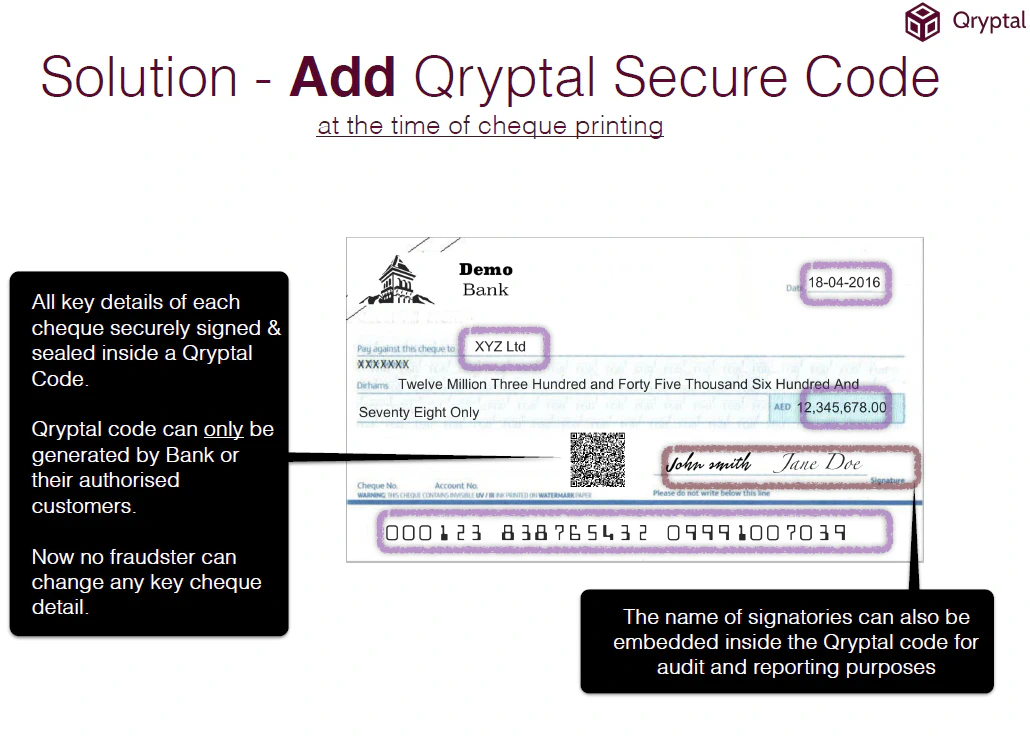

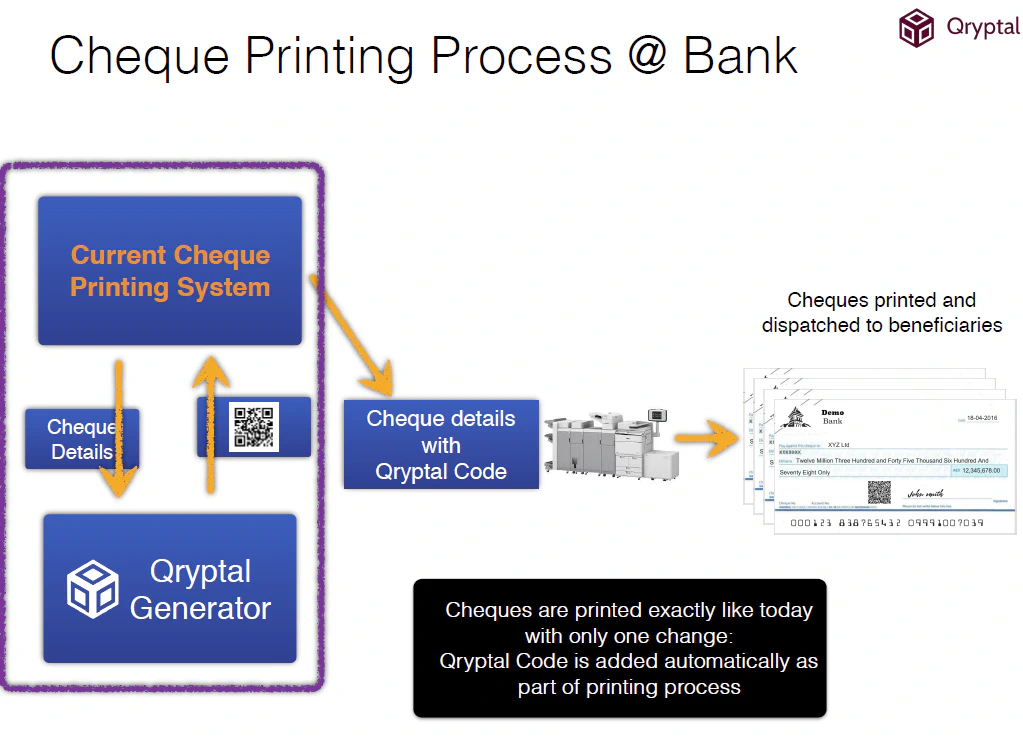

One way to do this is to add a Secure QR Code with details such as cheque number, account number and bank code stored inside. Cutting-edge technology similar to hyper ledger ensures that this high security, tamperproof code can only be created by the issuing bank. This QR code is machine readable and the information inside can be cross-checked with the MICR information to validate the cheque and identify the fraudulent ones. Most importantly the QR code is unique for ‘each’ cheque and can only be generated by the issuing organization. The technology can be easily integrated with the existing infrastructure and can handle the necessary processing volumes. Qryptal QR code financial services are privacy friendly with no dependency on cloud and zero sharing of customer sensitive information.

The QR code payment system is easy to implement and does not need a significant reworking of the current workflow of cheque processing.

To know more, please write to info@qryptal.com, who can help you with a Banking Whitepaper that can help you prevent cheque frauds.